Thinking of buying your first home but feeling lost in the numbers? A mortgage calculator might just become your new best friend.

Introduction

Buying your first home is exciting, but let’s be honest, it can also be overwhelming. Between down payments, interest rates, and loan terms, it’s easy to get confused. And the big question on your mind? “How much will I actually be paying every month?”

That’s where a mortgage calculator comes in. It’s a super simple online tool that gives you a clear estimate of your monthly payments—no complicated math required.

In this post, I’ll walk you through how mortgage calculators work, what details you need to use one, and how they can help you make smarter, more confident home-buying decisions: no jargon, no fluff, just real talk.

What is a mortgage calculator? (No Boring Definitions, Promise)

Okay, real talk, buying a house sounds cool, but the moment you hear words like loan, interest, or monthly payments, your brain kind of freezes, right? 😅

Enter Mortgage Calculator, your no-drama, zero-math-needed bestie.

It’s just a simple online tool that helps you figure out:

- What your monthly payment would look like

- How much interest you’ll end up paying (yeah, it adds up fast)

- And how long you’ll be stuck with that loan

Honestly, it’s like the calculator app on your phone, but instead of splitting pizza bills, it splits home loans.

And no, you don’t need to be a finance nerd to use it.

What Info Do You Actually Need?

Before using a mortgage calculator, I think you need to know four things very well, which isn’t too difficult.

🏠 Home Price – The total cost of the house you’ve been eyeing on Zillow or that random neighborhood walk.

💸 Down Payment – How much cash you’re ready to drop upfront. (Hint: More = less loan = smaller EMI)

📉 Interest Rate – Either what your bank is offering, or just Google “current mortgage rates” to get a ballpark idea.

📅 Loan Term – Basically, how long you want to be paying this off. Most folks go with 15 or 30 years, depending on their budget and patience level.

When you understand these four things, you will see how easy your life has become.

🛠 Step-by-Step: How to Use a Mortgage Calculator

🟢 Step 1: Type in the Home Price

Start simple, my friend. Just enter the price of the house you wish to buy.

Let’s say you found a place for $4,500,000. That’s the number you plug in. No need to overthink it.

You’re not doing math; you’re just telling the calculator.”

🟢 Step 2: Calculate Down Payment 💰

A down payment is the money that you pay upfront. You usually make a down payment of 10-20%. That means if your house is worth $400,000, then your down payment will be around $40,000-$80,000.

📊 And you can also enter the down payment in the mortgage calculator to see how the EMI is going to be less or more.

🟢 Step 3: Enter Interest Rate

🏦 Mortgage rates in the USA in 2025 are around 6.5-7%, but if you have a good credit score, you can get a reduction in rates, which will prove beneficial for you. Want to improve your score fast? Here’s how I went from 520 to 780 in less than a year

🟢 Step 4: Choose Loan Term

🕒 Generally the loan is for 15, 20, or even 30 years. The more your time period increases, the lower the EMI and the higher the interest.

🟢 Step 5: Click on Calculate

When you have entered all the necessary information, click on the calculate button.

The mortgage calculator will immediately show you the result!

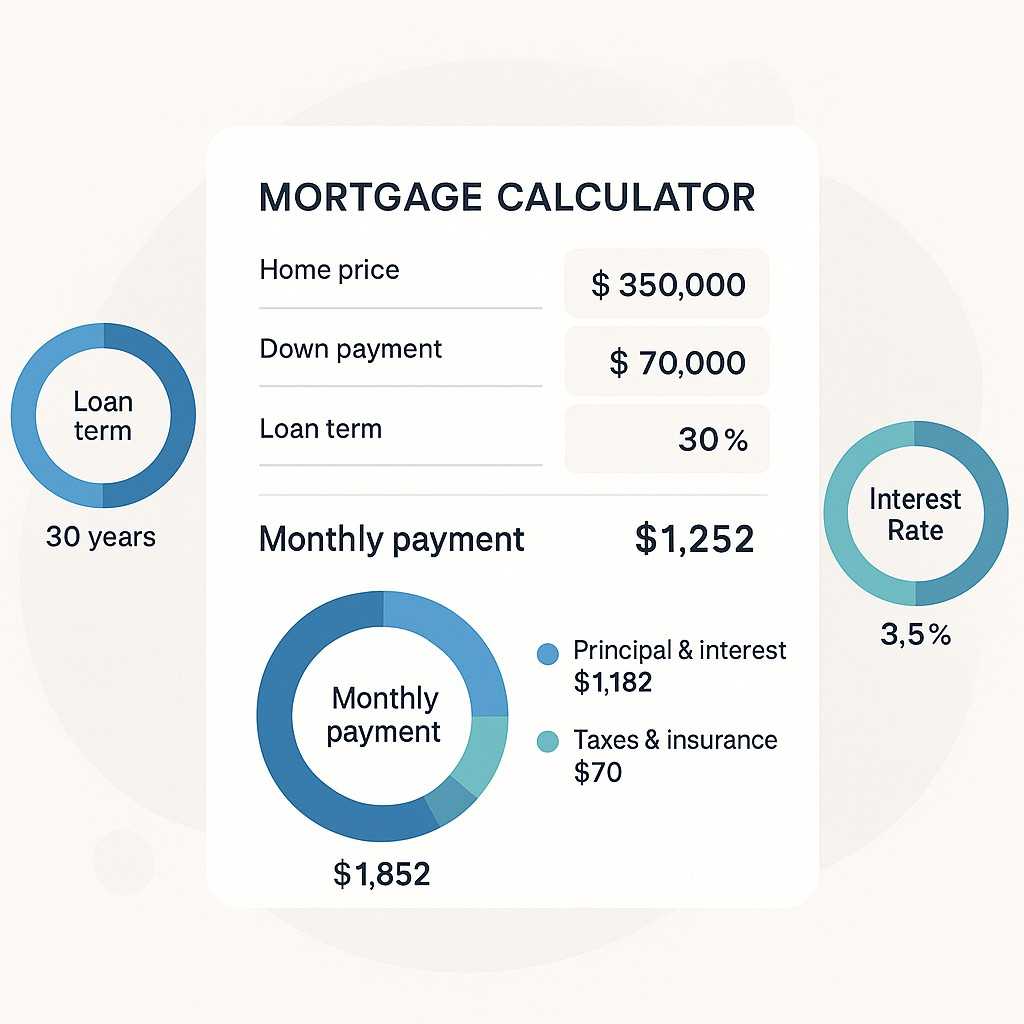

Monthly Payment Breakdown

Principal: What you are deducting from the original loan amountInterest:

The extra money you have to pay to the bank: Taxes: Property tax (if included in the payment) Insurance:

Homeowners insurance (if included) How much total interest will have to be paid? This tells you how much extra money you paid to the bank during the entire loan period. You might be surprised to see this number!

Amortization Schedule:

The name is complicated; the work is simple. It shows how much principal and interest you are paying each month.

Smart Tips: Getting The Best Results From Your Mortgage Calculator

Tip 1: Try different scenarios. Less or more down payment 15 vs 30-year loan Different interest rates

Tip 2: Try the extra payment option. If you pay an extra $200-$500 every month, see how much you can save with the calculator.

Tip 3: Don’t just look at the monthly payment. See the total loan cost too, i.e., how much you are paying in total at the end.

Common Mistakes People Make

- Looking only at monthly payments

Buying a house is not limited to just mortgage, taxes, maintenance, and bills; everything is included.

- Maxing out the budget

Experts say that housing expenses should not be more than 28-30% of your income.

- Forgetting the emergency fund

Did you lose your job? Or did you get a big repair bill? The calculator does not tell these things.

- Ignoring hidden costs

Closing costs, appraisal fees, and inspection charges also happen but are not visible in the calculator.

Types of Mortgage Calculators

Basic Calculator: Only tells the principal and interest

Advanced Calculator: Also includes Taxes, insurance, PMI

Refinance Calculator: For those who want to take a loan again

Extra Payment Calculator: How much are you saving after making an extra payment?

Current Mortgage Market: (2025)

Interest rates are a bit high in 2025 but still fine according to historical standards.

Excellent Credit (760+): 6.5%–6.8%

Good Credit (720–759): 6.8%–7.1%

Fair Credit (680–719): 7.1%–7.5%

Low Credit: 7.5%+

Always use the current rate for accurate results.

Real-Life Example

Let’s understand this through a real example:

Home price: $500,000

Down payment: $100,000 (20%)

Loan amount: $400,000

Interest rate: 7%

Loan term: 30 years

Mortgage calculator result:

Monthly payment: Taqreeban $2,661

Total interest: Approximately $558,000

Total amount paid: Approximately $958,000

See? A loan of $400,000 eventually becomes just an interest of $558,000. That’s why using a mortgage calculator is very important for planning.

Money-Saving Tips

Tip 1: Pay a higher down payment

If you can afford it, pay more money in the beginning.

Low loan = low monthly payment = low interest.

Tip 2: Choose a shorter loan term

If you take a loan of 15 years instead of 30 years, you can save thousands of dollars in interest (the monthly payment will be a little more).

Tip 3: Make extra payments

Did you get a bonus or a tax refund? Apply it to the mortgage principal.

Check with a calculator how much savings you make.

Tip 4: Compare rates

A difference of just 0.25% can save you thousands of dollars.

Mortgage Calculator Limitations

- The mortgage calculator is quite helpful, but it does not cover some things:

- Only gives estimates, not exact numbers

- Closing costs and fees are not included

- It does not guarantee loan approval

- It does not predict future changes in the market

So this is just a starting tool; definitely talk to the lender for the real numbers

Red-Flags When not to rely on the mortgage calculator

Red Flag 1: Showing a very good rate

If the calculator shows an unrealistic rate, be suspicious.

Red Flag 2: Does not show payment breakdown

A good calculator shows you the proper breakdown of principal, interest, tax, and insurance.

Red Flag 3: Using old data

Confirm that the calculator is using current rates and terms.

Best Practices: Best Use of Calculator

- Do the following:

- Compare results from different calculators

- Use conservative estimates

- Include all possible expenses

- Try multiple scenarios

- Take advice from professionals

My Final Advice

Friends, this is a powerful tool, but it is only the first step.

Before taking a final decision, make sure to do the following:

- Take advice from a financial advisor

- Take pre-approval from multiple lenders

- Read all legal documents carefully

- If necessary, take legal advice

- Do not take decisions in a hurry—take steps after thinking carefully

Buying a house is one of the biggest investments of life. The calculator helps you understand, but it is also important to take guidance from professionals.

Disclaimer

This information is only for general guidance. The actual terms and rates of the loan may change depending on the lender and market conditions. It is always better to take professional financial advice.

Pingback: 7 Proven Tips on How to Lower Your Mortgage Payments Fast Without Refinancing

Pingback: Tax Season Made Simple: A Beginner’s Guide to Filing in the U.S