Let me be honest: this is a very interesting thing. Whenever China cracks down, the crypto market gets a fever. And what about this? Not just crackdowns; a full-on crackdown is going on.

If you have seen that the “China cryptocurrency crackdown” is trending, I thought we should also talk about it. “Wait, didn’t they already create crypto?” Friends, this has already happened with us. Don’t worry, you are not alone.

But 2025? This thing is different. Let’s see what is really happening without anyone’s nonsense.

🧨 What’s New in the Crackdown?

- Mining and trading have been banned since 2021. But now? Holding is also in the target.

- People’s wallets are being seized, and their assets are being liquidated through Hong Kong exchanges.

- One case? A guy from Shanghai who had a 1.3 BTC cold wallet was just holding it; he did not even trade but got confiscated. 😳 What a strange thing, isn’t it?

In Q2 2025, authorities reportedly seized digital assets worth more than $1.6 billion in “unauthorised holdings”. (source) The China cryptocurrency crackdown isn’t just noise; it’s action.

🔍 Why now? What is China’s motive?

In my opinion there are two core things: control and strategic timing.

- Total control – China has historically been interested only in things where it has 100% control. And decentralised cryptocurrencies like Bitcoin or Ethereum are against its narrative.

The China cryptocurrency crackdown of 2025 is the logical next step in this long-term narrative. - Aggressive push of Digital Yuan – China is creating a clear path to get Central Bank Digital Currency, i.e., Digital Yuan, adopted globally. As long as people have BTC or stablecoins, the appeal of the digital youth will remain limited.

So systematically eliminating competition has become part of their economic strategy.

As they say, “Neither crypto will remain, nor will users take it.”

📉 How is the market reaction?

You must be thinking, “I am in the US or Europe; what difference does it make to me?”

Crypto markets run on global emotions. Whenever there are headlines like China bans Bitcoin or China cryptocurrency crackdown, a BTC price drop is almost guaranteed.

| 🕓 Timeline | 🪙 Bitcoin Price |

|---|---|

| May 2025 (pre-news) | ~$112,000 |

| Mid-June (seizure stories hit) | ~$98,500 |

| Late July (market stabilizes) | ~$105,000 |

But the twist? Every time China bans crypto, the market shakes… then bounces back. 📈

But, this time it feels like this is perhaps the beginning of some big chapter. Because the 2025 cryptocurrency crackdown seems more structured and forceful. What do you think? Is the digital yuan the future or a surveillance tool?”

🧊 Hong Kong: Cool Version of Crackdown

While Beijing is cracking down, Hong Kong is doing something else but in the same crypto space.

Remember that $1.6B seized crypto? Much of it is being sold through Hong Kong-licensed exchanges via court orders.

Meaning, a wild contrast is being found:

More interesting?

Hong Kong has launched the Stablecoin Ordinance (1st August 2025). So far 40+ firms like Circle, Ant Digital, and JD.com have applied for licences (source).

Meaning, a wild contrast is being found:

- Mainland: 🔒 clampdown

- Hong Kong: 🛣 stablecoin innovation

The China cryptocurrency crackdown is not just a story but a split strategy: pressure at home, profit from outside. It has become a bit hypocritical but brilliant.

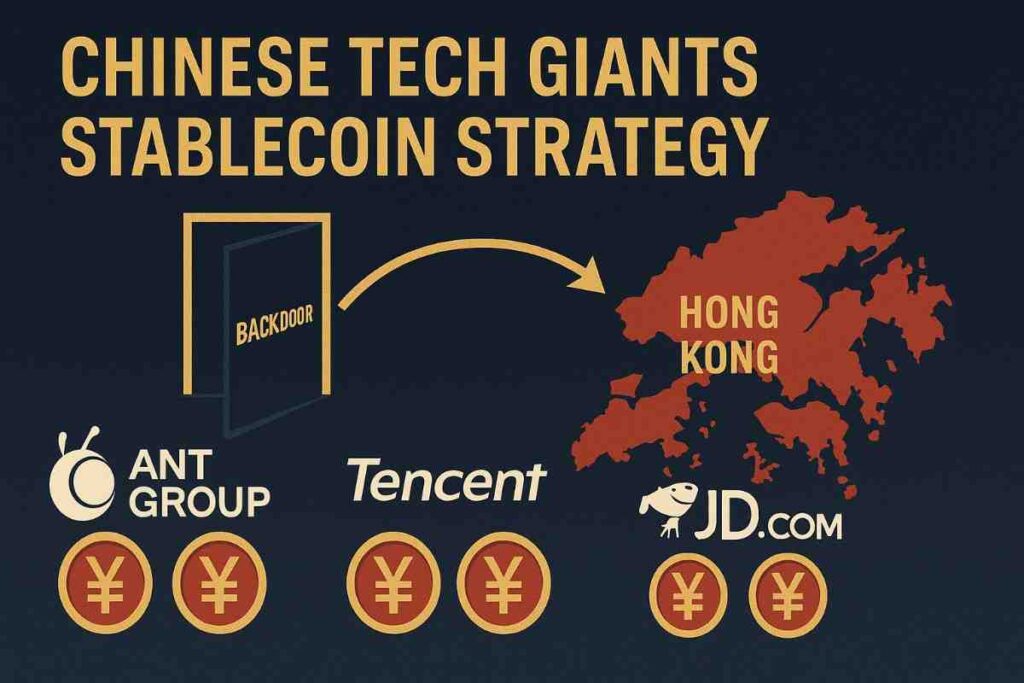

💸 Stablecoins: China’s Backdoor Planning?

The story gets a bit spicy here. 🌶️

While China is banning Bitcoin and major cryptos, its tech giants like Ant Group, Tencent, and JD.com are quietly developing yuan-pegged stablecoins, mostly under the framework of Hong Kong stablecoin regulations.

So while they ban BTC at home, they’re quietly building yuan-backed crypto abroad. The China cryptocurrency crackdown might actually be the setup for something bigger, a state-friendly crypto ecosystem.

So technically:

🚫 Bitcoin banned

✅ Chinese stablecoin planned smart strategy? Definitely.

Transparent? Not really.

🤔 Should You Be Worried?

Don’t panic, but don’t ignore it either.

This is not just China crypto ban news; it’s a fight for control of the future of finance.

If you are in your 20s or 30s, don’t just invest money in crypto; it’s also important to understand its geopolitics.

What should you do now?

- Use your non-custodial wallets

- Don’t keep high-value holdings on centralized exchanges

- Actively follow the Digital Yuan vs Bitcoin debate

- Keep an eye on emerging crypto hubs like Hong Kong and the UAE.

This is all part of being prepared for the future.

Because the China cryptocurrency crackdown of 2025 may not just be a headline; it could be a trailer for a global shift.

📊 Recap: The Crackdown at a Glance

| 🔍 What Happened | 📌 Detail |

|---|---|

| Focus | China cryptocurrency crackdown targeting even ownership |

| Assets seized Q2 2025 | $1.6B+ |

| Hong Kong’s role | Liquidating seized assets + launching stablecoin licenses |

| BTC price dip (May–June) | ~12% drop |

| Stablecoin license applicants | 40+ firms (Ant, JD, Circle, SCB) |

| Notable startup | YuanLink Labs ($30M raised, July 2025) |

Sources: Reuters, Reuters, SFCCN

❤️ Final Thoughts (Just You & Me)

I have seen “China bans crypto” headlines so many times that I have lost count.

But this China cryptocurrency crackdown seems to be more well thought out and coordinated to me.

And I feel we should not see what is stopping us from doing it. Rather, we should see what he is creating. Because that’s where the real story is.

Stay curious. Ask the uncomfortable questions. And don’t assume what’s trending today is the whole picture. 😉

FAQ: Real Questions About China’s Cryptocurrency Crackdown

1: Can you still buy or hold Bitcoin in China?

A: No. China has now legalised not only the trading and mining of cryptocurrencies such as Bitcoin and Ethereum but also their storage. If you have coins in a private wallet, that too is now illegal. (source)

Q2: Is crypto mining completely banned?

A: Yes, crypto mining has been completely banned in the entire country since 2021, and enforcement is quite strict. This is part of China’s wider plan to reduce energy usage and promote its digital yuan currency. (source)

Q3: How many bans have been imposed before this?

A: It’s hard to believe, but this crackdown is just one more ban in a long list of old bans. Since 2013, China has imposed 9 or 10 different bans, each targeting some area such as ICOs, exchanges, mining, or even crypto advertising. (source)

Q4: How strict is the enforcement?

A: A lot. The PBOC and other agencies are monitoring transactions, punishing violators, and even seizing wallets. A Shanghai man was punished for having only 1.3 BTC in his cold wallet; he hadn’t even done any trading. (source)

Q5: Does this cryptocurrency crackdown apply to Hong Kong?

A: No, not completely. Hong Kong has its own crypto rules. A new Stablecoin Ordinance came into effect on 1 August 2025, and more than 40 companies have applied to license yuan-pegged stablecoins. This is part of the broader China crypto policy, but mainland rules do not apply to Hong Kong. (source)