Many people start investing by opening an account and immediately trusting a “financial advisor” or broker without first checking if the person is legitimate. Just as you do a quick background check before hiring a babysitter, it’s essential to do the same when it comes to your money.

This is where FINRA BrokerCheck comes in. It’s a simple tool that lets you view the public record of a broker or advisor. I honestly didn’t know about it until a friend of mine got into trouble with a shady “financial guy.”

In this post, I’ll explain what FINRA BrokerCheck is, how to use it, and why every investor should check it.

What Is FINRA BrokerCheck?

To put it in simple terms, FINRA BrokerCheck is like LinkedIn for brokers and financial advisors, but with a lot more honesty. It’s a free online tool provided by FINRA (Financial Industry Regulatory Authority), which is essentially Wall Street’s referee.

When you enter a broker’s name into FINRA BrokerCheck, you don’t just get a nice photo and fancy titles. You get the real data:

- Where they have worked.

- Whether they are licensed to sell specific investments.

- If they have any complaints or disciplinary cases.

- Small details, like which exams they passed and if they were ever fired from a firm.

Think of it as seeing someone’s true colors before giving them your money. Because let’s be honest, a slick website or smooth talk isn’t always trustworthy.

For example, I once searched for a random person on FINRA BrokerCheck who was writing “DM me for investment advice” on Instagram. Guess what happened? Their name wasn’t even on the list, which was a clear signal that they were unlicensed. Yikes!

Why Should You Care About BrokerCheck?

You might be thinking, “Do I really need to check my broker?” (Yes, you absolutely do.) If you don’t, you could potentially suffer significant losses. The two minutes you spend checking can save you thousands or even hundreds of thousands of dollars. Here’s why FINRA BrokerCheck is so important.

Key Importance of FINRA BrokerCheck

- Transparency for Investors: It verifies that a broker or firm is properly registered and licensed, giving you confidence that you’re working with a legitimate professional.

- Background Check: It shows a broker’s employment history, exams, and licenses. You can also see if there have been any regulatory actions, customer complaints, or disciplinary records.

- Informed Decision-Making: You can easily compare different brokers. If a broker has an unstable job history or a lot of complaints, you can spot those red flags.

- Fraud Prevention: Checking a broker’s history can help you avoid scams and misconduct.

How to Use FINRA BrokerCheck

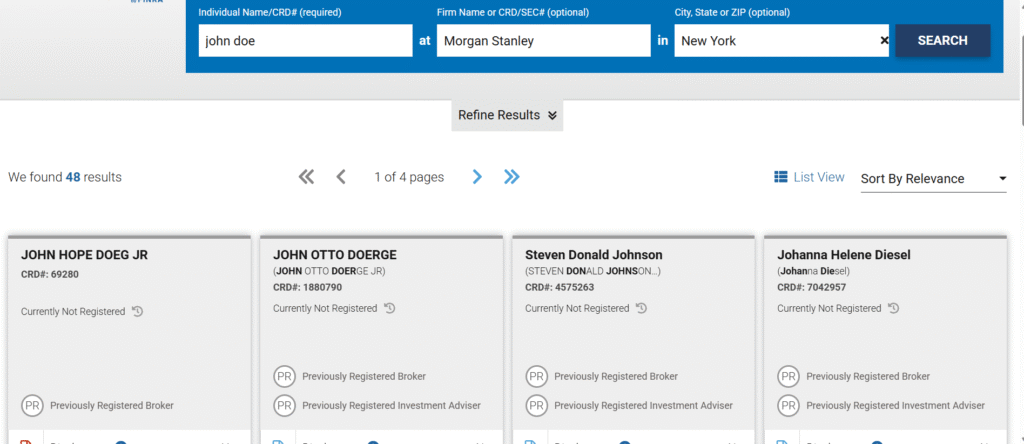

- Open the Website: Go to brokercheck.finra.org in your browser.

- Search by Name or CRD/SEC Number: You can search for a broker or financial advisor by name. If you know their CRD (Central Registration Depository) number or the firm’s SEC (Securities and Exchange Commission) number, you can also enter that.

- View the Results: After searching, you’ll see a list of brokers, advisors, or firms. Select the correct name.

- Check the Profile: Once you click on a profile, you can see details like:

- The broker/advisor’s registration history.

- The licenses and exams they have passed.

- Their employment history (which firms they have worked with).

- Any disciplinary actions, complaints, or disclosures.

5. Compare: If you’re considering multiple advisors, you can compare their profiles to help you make a decision.

BrokerCheck is free and open to the public. Using it helps ensure that the financial advisor you choose is registered and trustworthy. (And if you want to learn FINRA BrokerCheck in detail, click here.)

Understanding FINRA BrokerCheck Results

Opening a profile is easy, but it’s crucial to know whether the results are green, yellow, or a potential red flag.

Green Signs (Good Things)

- Licenses are “current,” meaning the person is legally allowed to do business.

- Stable work history (e.g., worked at only 1-2 firms in 10 years).

- No disclosures, indicating a clean record.

Yellow Signs (Caution)

- Changes jobs every year.

- Small disputes that were dismissed or denied.

- Outdated information (inactive licenses or old addresses).

Red Signs (Danger)

- Multiple disclosures with payouts.

- Regulatory actions (fines, suspension, or a ban).

- The person’s name isn’t even on BrokerCheck.

I have a personal example. A few years ago, an “advisor” messaged me on social media. I checked BrokerCheck and found three disclosures and a suspension. Giving my money to someone like that would have been a huge risk.

Remember: FINRA BrokerCheck isn’t meant to scare you; it’s meant to help you make an informed choice. A clean report isn’t a guarantee of a good outcome, but a messy report can definitely save you from a bad one.

Understanding FINRA BrokerCheck: My Perspective

I view it as an early-warning system. It shows you big red flags, yellow caution signs, and green lights. However, it can’t tell you everything, like whether your broker will actually listen to you, clearly explain things, or if they are a decent person. This is where your instincts, questions, and other research come into play.

I was once scrolling through Reddit and came across a post from a woman who shared her story.

She saw a “top-rated” advisor on an app whose profile looked great at first glance. But when she did a little digging on FINRA BrokerCheck, some past disputes came up. She asked the advisor directly, and his explanation made sense. That’s when she realized that a conversation often provides much more clarity than the tool itself.

Key Takeaways

- Use it early: Check BrokerCheck before you sign anything.

- Read the details: Don’t just look at the headlines. Context matters.

- Cross-check information: Look at the SEC, state regulators, and LinkedIn to get the full picture.

- Ask questions: Transparency is a strong signal of trust.

- Look for patterns, not single incidents: A single dismissed complaint isn’t a dealbreaker.

Do you have any questions about how to use FINRA BrokerCheck, or would you like me to find a specific firm or broker for you?