Can You Really Make Money with Green Investing? Short answer? Yes, and I’ve seen it happen. Why don’t I tell you a little story about myself? Let me tell you how my thinking changed.

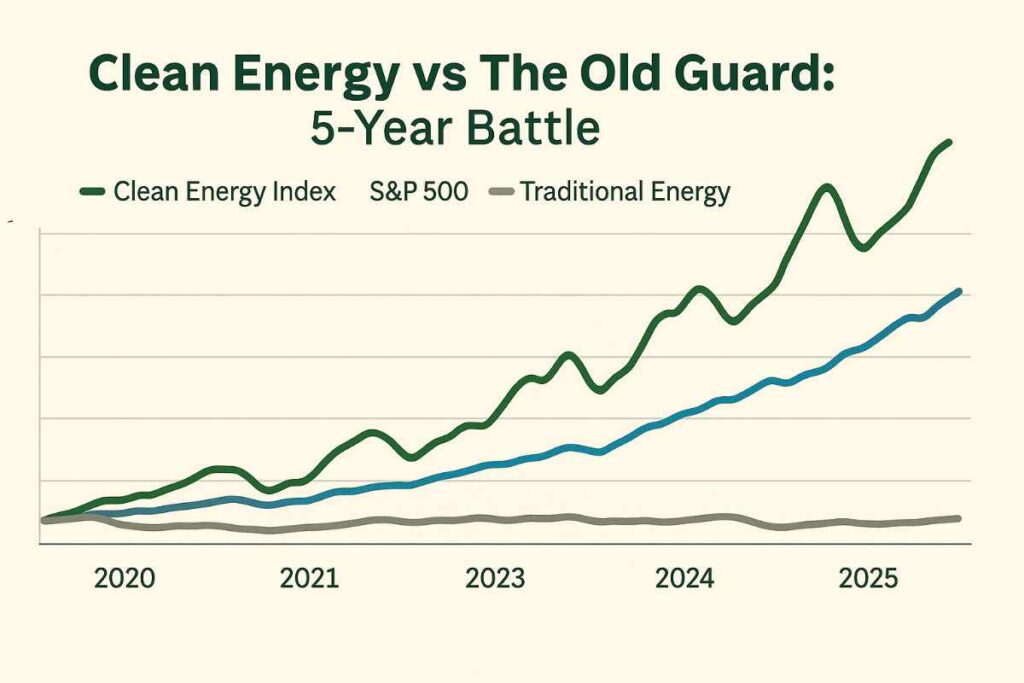

In 2020, when everyone was selling stocks in panic during COVID, I invested some money in a clean energy ETF. I am not an environmental hero (yes, I do recycling sometimes…), I just felt the future of renewable energy was strong.

By 2025, those “green” investments often outperformed my regular investments.

So What Is Green Investing?

Green investing is putting your money into companies building a sustainable future. Think: solar power, electric cars, clean water, and eco-tech.

It’s also called ESG investing (Environmental, Social, Governance). Why It’s Blowing Up If you can see, this is no longer just a feel-good trend. Now trillions of dollars are going into green investing.

Big players like pension funds, universities, and even retirement accounts are on board. But It’s Not Perfect Greenwashing is real; some companies fake the “eco” image. Some funds charge higher fees. Returns aren’t always amazing. Do your research.

Why I’m Still In

Feels good to invest in something that’s actually making a difference. You’re not just betting on the market; you’re betting on the future. For me, it’s not about being perfect, just being intentional.

Your Green Investing Toolkit: Invest Money in Green Projects

If you are convinced that green investing is not just for eco-lovers, then I think you are ready. So let’s see where we should invest our money. I remember when I started, I was very confused looking at investing apps. ESG, sustainable, impact… I did not understand anything.

So let’s start with something simple.

ESG ETFs and Mutual Funds: Easy Mode of Green Investing

Consider this your starter pack. You don’t need to choose different stocks here; these funds already invest in companies that are environment-friendly.

Popular ESG Funds You’ll Actually Recognize:

| Fund Name | Ticker | What It Does | Why I Like It |

|---|---|---|---|

| Vanguard ESG U.S. Stock ETF | ESGV | Covers the broad U.S. market, excluding unethical companies | Low fees and the reliability of Vanguard |

| iShares MSCI ACWI ESG Fund | ESGU | Provides global coverage across many countries | Great for international exposure |

| Invesco QQQ Trust ESG | QQQM | Focuses on tech-heavy companies with better ESG standards | Ideal if you love tech but want a greener portfolio |

The benefit? Diversification. Your money is spread across clean energy, water projects, and sustainable farming.

Green Bonds: Simple and Stable

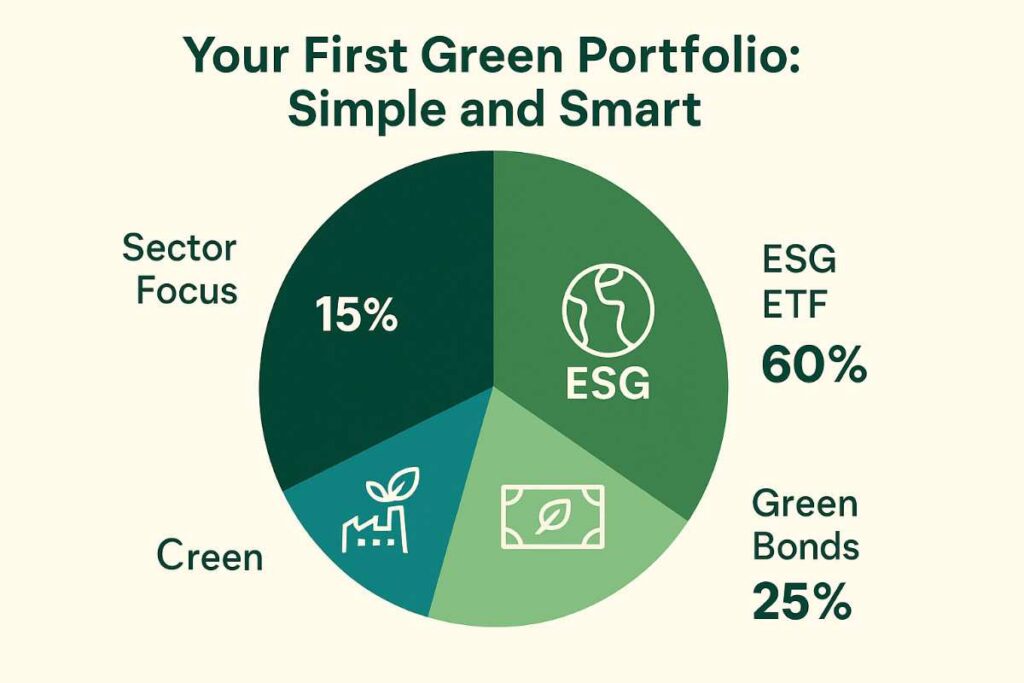

The current green bonds are those where money goes directly into environmental projects like solar farms or electric buses. The returns are moderate, but the risk is also low. And I keep my 15% in this for stability.

Clean Energy Stocks: A little Risk, a Little Reward

This will seem like an adventurous zone to you to some extent. Sometimes the stocks go high, sometimes they crash due to the news. But if you make the right choice, it is beneficial.

Popular Names:

- Tesla (TSLA)—does more than cars

- NextEra Energy (NEE)—Utility company, but future-ready

- Enphase Energy (ENPH)—solid solar tech

Why Green Investing Actually Makes Financial Sense (Not Just a Good Feeling)

I thought green investing was basically like charity, just a little dramatic. But when I saw my actual returns, I was stunned. Because I was totally wrong.

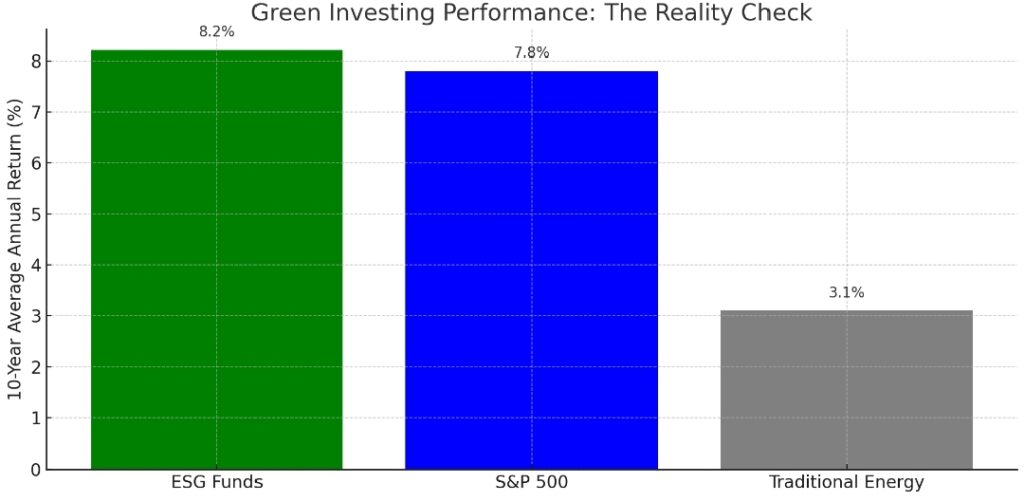

Performance numbers don’t lie.

And when I first saw the data, the thing that made me sad was this.

- Often large ESG funds have matched or beat the S&P 500 over the last 10 years.

- The clean energy sector returned an average of 9.3% per year from 2015 to 2024.

- And fossil fuel investments? We have are losing money since 2018

But the fact is that not only has time passed, but the future trend is also moving towards sustainable companies.

Government Money Is Flowing Like Crazy

This part is very interesting from the profit point of view:

- $370 billion of clean energy incentives through the U.S. Inflation Reduction Act

- Up to 30% tax credits for solar installations, until 2032

- EV tax credits up to $7,500—as the adoption of electric vehicles is accelerating

- Green bonds are getting special treatment from regulators

When Uncle Sam is showering money on an industry, it is foolish to ignore it. I am not saying that you should just run away after the subsidy, but do not ignore such big numbers.

The “Future-Proofing” Factor

To be honest, I don’t like buzzwords either, but some trends are really inevitable.

Think about it: what will be more popular in 2030?

- Will more coal plants be built, or will they be shut down?

- Will gas cars be cheaper, or will electric cars dominate all?

- Will companies ignore carbon footprint or start taking it seriously?

If I talk about myself, I think green investing is actually like betting on what the future will be like, not how the world looks today. And honestly? This thinking helped me earn good money.

Risk Management (a little Boring, But important)

What people miss is this: green investing can reduce the risk of your portfolio.

How? These are the three reasons:

- Regulatory protection—Clean companies have less chance of massive fines or bans

- Resource independence—The cost of solar and wind is predictable, not oil

- Consumer trends—Today’s young consumers prefer sustainable brands

I understood all this in the energy crisis of 2022. My traditional energy portfolio was shaken by price volatility. Renewable energy ones remained almost stable.

The Corporate Shift is Real

This isn’t just about individual investors anymore. Check out what’s happening:

| Company | Green Commitment | What It Means for Investors |

|---|---|---|

| Apple | Carbon neutral by 2030 | Massive supply chain changes |

| Microsoft | Carbon negative by 2030 | Billions in clean tech investments |

| Amazon | Net zero by 2040 | Huge logistics transformation |

| 24/7 renewable energy by 2030 | Data center revolution |

When tech giants are rebuilding their entire operations around sustainability, the companies that are helping them are becoming the main source of income.

Tax Benefits You Really Want to Know

Okay, taxes are boring—but money is not boring:

- ESG funds have a low turnover—meaning fewer taxable events

- Green bonds are sometimes tax-free (especially municipal ones)

- Direct renewable investments benefit from accelerated depreciation

- Energy efficiency investments (like real estate) get different tax breaks

I’m not a tax advisor (obviously), but my accountant definitely noticed when I shifted my investments to the green side.

The Compound Effect

The most underrated benefit? Green investing connects you to long-term trends early on. Climate change is not going away. Resources are getting scarcer. Regulations are getting stricter. And consumer trends are shifting permanently. When you invest in companies that solve problems, not create them, you are essentially betting:

“Problems will get bigger, and the value of solutions will get bigger.” And it’s really happening.

Look, I’m not saying green investing is a magic money machine. No investment is guaranteed.

But the data shows it’s not a financial sacrifice—it’s one of my best strategic moves.

The real question is not whether sustainable companies will do better or not…

The real question is this: Waste Management (WM)—waste is also handled smartly

Getting Started: Your Step-by-Step Action Plan

I remember my first green investment. I did three hours of research and invested $500 in a random clean energy ETF, and that too on Tuesday night at 11 o’clock. There was no strategic planning, but everyone starts somewhere. This is the method I should have followed from the beginning.

Step 1: Understand Your Risk Tolerance (and Answer It To Yourself.)

Ask yourself:

- If your investment falls 20% in a month, will you be able to sleep peacefully?

- Are you investing money that you won’t need in the next 5 years?

- Do you check your portfolio daily, every week, or occasionally?

My Suggestion Based On Risk Levels:

| Risk Level | Green Investment Approach | Typical Allocation |

|---|---|---|

| Conservative | Mix of ESG ETFs and some individual stocks | 70% bonds, 30% stocks |

| Moderate | Mix of ESG ETFs + some individual stocks | 40% bonds, 60% stocks |

| Aggressive | ESG index funds and green bonds | 20% bonds, 80% stocks |

Step 2: Pick Your Platform (Don’t Overthink This)

You have to actually buy these investments somewhere. Here are the platforms I used to do it and what I think of them:

For Beginners

- Fidelity—zero fees on most ETFs, good research tools

- Vanguard—cheapest index funds, boring but reliable

- Charles Schwab—solid from every angle, good customer service

For Advanced People:

- E*TRADE—great for options trading

- TD Ameritrade – good research platform (now part of Schwab)

The bottom line is this:

Choose a great broker and get started. Don’t spend too much time comparing.

Step 3: Start With the Basics (Your Core Holdings)

People make a mistake here; they run straight to flashy stocks and don’t build a foundation.

My “Boring But Smart” Beginner Portfolio:

- 60% – Broad ESG ETF (like ESGV or ESGU)

- 25% – Green bonds or bond fund

- 15% – A sector you understand (clean energy, sustainable agriculture, etc.)

This works for you: you get wide diversification, stability, and a little excitement without taking too much risk.

Step 4: Dollar-Cost Average Your Way In

Don’t try to time the market. I’ve tried it – it’s just an expensive gamble.

Instead, set up automatic investments. I put $300 into my ESG fund every two weeks, and then add more when I get a bonus or have some extra money.

This works for the following:

- When the price is low, you get more shares

- When the price is high, you get fewer shares

- You don’t have to decide on timing

- Get used to being consistent

Step 5: Do Research, But Not So Much That You Get Paralyzed.

Here’s the research process that actually works:

For ETFs or Funds:

1. Check Expense ratio (less than 0.5% is good)

2. Check Top 10 holdings – do you like these companies?

3. Read a new article about the fund

4. Compare 5-year performance with benchmark

For Individual Stocks:

1. Understand what the company actually does

2. Is it making a profit?

3. Look at the real environmental commitment, not just marketing

4. Read the last quarterly report (or skim it)

Useful Websites:

- Morningstar.com – Fund research and ratings

- SEC.gov – Company filings (boring but important)

- Yahoo Finance – For quick stats and news

- Company websites – Sustainability reports (check if they are real or just PR)

Step 6: Avoid These Rookie Mistakes

I’ve made all of these, so learn from my pain:

DON’T:

- Do not invest all your money in a hot green stock

- Do not invest money in investments that you cannot explain to your friends

- Do not panic sell when the market falls

- Do not ignore fees they get added quickly

- Do not run after the “next Tesla”

DO:

- Start with a small amount, grow slowly

- Rebalance once or twice a year

- Keep regular investments as well (diversification is important)

- Read about the things you are investing in

- Set up automatic contributions

Step 7: Track Progress (But Not Obsessively)

I check my green investments once a month usually on the first Sunday. If you look too much, emotions interfere. If you look too little, control is lost.

TRACK:

- Overall performance compared to S&P 500

- Any significant change in your fund holdings

- New opportunities that match your strategy

- Are you on track for your goals?

Simple Tracking Table:

| Investment | Amount | Monthly Return | Notes |

|---|---|---|---|

| ESG ETF | $5,000 | +2.1% | Solid month |

| Green Bonds | $2,000 | +0.8% | Steady as usual |

| Solar Stock | $1,000 | -3.2% | Quarterly earnings miss |

Your Action Plan for This Week

Stop worrying about green investing and start acting:

- If you don’t have an account today, open one with a major broker.

- And tomorrow start transferring $500-$1000 (as much as you can afford).

- This weekend: Buy your first ESG ETF.

- Because it’s the easiest way to invest in green investing.

Now we’ll talk about some of the traps and red flags that fool us in the name of green investing.

Performance and Case Studies: The Real Case of Green Investing

Let’s get to the point and see how green investing actually performed.

Now we will see the investment type, which year was the best for annual profit and when did the loss occur.

🌿 ESG Funds vs. Market

Vanguard ESG ETF (ESGV) annual returns (2019–2024):

- 2019: ~33.4%

- 2020: ~25.7%

- 2021: ~26.6%

- 2022: −24.0%

- 2023: +30.8%

- 2024: +24.7%

- 2025 YTD (till now): approximately +7.7%

All this together is generating approximately 9.9% compound annual return till June 2025.

Compared to S&P 500: ESGV is responding, but declines are less and trends are steady. And the best part it stays far away from fossil fuel companies. It is not even behind the total market.

🚗 Tesla & The Rollercoaster Ride

Tesla stock returns:

- 2019: +36.7%

- 2020: +731%

- 2021: +46.9%

- 2022: −67.8%

- 2023: +109.7%

- 2024: +61.5%

- 2025 (till now): −18.2%

5 year total return: ~+222%, meaning if you had invested $1,000 5 years ago, now it would have been ~$3,217.

Tesla’s journey: full drama sometimes fast, sometimes crash but still the poster boy of green investing.

☑️ ESG Funds: They really deliver

From 2019 to mid-2025, ESGV has:

- Gave ~9.9% annual return

- Fluctuating within ~±30%

- Staying away from big polluters

Meaning, they give steady returns which you can also verify online.

⚠️ Wins & Blunders

- Solar startups and hydrogen companies caused a lot of damage

- Some clean-tech IPOs only burned cash

- I invested $2,000 in a fuel-cell stock in 2020 down ~70% so far 😞

Everything: Green stocks are either a bust or a crash. There are fewer surprises in ESG funds.

🏦 Green Bonds = Quiet and Stable

No glamour, but solid performance:

- Municipal green bonds: ~4% annually, default is rare

- Corporate green bonds: ~4.5–5.1%, low volatility

Good, quiet returns are part of the green portfolio.

🎢 Volatility Timeline

- 2020: Green investing boom

- 2021: And it has gone up

- 2022: Big correction

- 2023–2024: Returns stability

- 2025 (till now): Mixed a little dip

If you can’t handle the 20–30% swings, then ESG funds are better than picking green stocks.

🧠 What I learned

- Green investing does not reduce returns

- ESG funds are predictable and stable

- Individual green stocks = high risk, high reward

- Market swings are often policy-driven

- Long-term sustainability trend is strong but be sure to diversify

💰 My Portfolio So Far

40% of my portfolio is invested in green investing, with an annualized return of ~9.9% from 2019 to June 2025. Rest of the return? About 8–9%.

Not much difference, but I sleep peacefully because I am betting on the future.

🔗 Links to Verify

According to my calculations, this data may be slightly wrong. If you want to get accurate data then you can verify it from here?

📈 ESG & Market Performance

- ESGV 5-Year Performance – YCharts

- S&P 500 Returns by Year – Macrotrends

- ESGV Holdings (FossilFreeFunds)

🚗 Tesla & Clean Tech Stocks

- TSLA Stock Performance – FinanceCharts

- Tesla Annual Returns – StatMuse

- Enphase Energy Stock – Yahoo Finance

- Albemarle Corp Stock – Yahoo Finance

- NextEra Energy – Google Finance

🌱 Sector Performance & Green Bonds

- Best Clean Energy Stocks – Investopedia

- Clean Energy ETF Returns – Morningstar

- Municipal Green Bond Yields – MSRB

- Corporate Green Bond Overview – S&P Global

Final Thoughts: Is Green Investing for You?

Look… I didn’t come to sell any dreams.

But if you are still waiting for some magical “perfect moment” to start investing then spoiler alert: there never is such a moment.

What happens is this: You + a little effort + a little consistency = a future-ready portfolio.

I started with just $500. That too on a random Tuesday. With absolutely zero knowledge.

Yes, it is true that I faced a lot of problems in the beginning and you will also face them but I knew my destination, that is why I kept on going and never looked back.

You also have to do the same, do not give up on problems, but fight them.

“Difficulties in life are intended to make us better, not bitter.”

Dan Reeves

💡 Wow, I wish I had known earlier

Green investing is not just about hugging trees. This is actually a way to understand which way the flow of money is going

As Morgan Housel wrote in his book The Psychology of Money:

“Doing well with money does not depend on how smart you are, but on how you behave.”

Damn. This thing hit me right in the heart.

Talk to me

If you are confused, curious, or have been cheated by a green stock and want to rant…

Then comment or send a DM.

Because if we are betting on the future…

Then doing it together is more fun. ✌

SOME USEFUL LINKS

- Mortgage Calculator: The Simplest Way to Figure Out Your Home Loan Payments

- How to Improve Your Credit Score Quickly: My Journey from 520 to 780 (And How You Can Too)

- How to Start a Portfolio with No Experience: 5 Steps to Get Started from Scratch (2025)

- How to Save Money Fast (Without Feeling Like You’re Missing Out)

- How to get out of student loan debt (2025)