I won’t sugarcoat it.

Three years ago, I was sitting in my car outside a bank, holding a loan rejection letter with shaky hands. My credit score? A painful 520. I’d made just about every financial mistake possible, and I was paying the price with sky-high interest rates, rejections, and stress.

But I didn’t stay there. After a lot of trial, error, and learning, I managed to raise my credit score to 780 in just 18 months. And I’ve since helped friends and family do the same.

If you’re serious about improving your credit score fast, you’re in the right place. I’ll share the exact strategies I used, what worked, what failed, and what actually made a difference. Want to check your current score first? Try this free tool; it’s what I used to track my progress.

Why Your Credit Score Matters More Than You Think

Before we jump into the “how to improve your credit score quickly” game plan, let me hit you with a quick reality check. When my score finally hit 780, I refinanced my car loan and started saving $187 a month.

That’s $2,244 a year, enough for a vacation, a new laptop, or, let’s be honest, way too much coffee. Your credit score isn’t just a boring number banks obsess over. It’s basically your financial dating profile, and trust me, lenders swipe left real fast if it’s a mess.

Here’s what your score actually influences:

- Whether you’ll get approved for loans or credit cards

- The interest rates you’ll pay (or the thousands you could save)

- Car and home insurance premiums

- Whether you’ll need to fork over security deposits for utilities

- And yes, even some job offers, especially in finance or government

Don’t believe me? Even the Consumer Financial Protection Bureau confirms its source.

📊 What Your Credit Score Really Means

| Credit Score Range | Label | Real-World Translation 🧐 |

|---|---|---|

| 300–579 | Poor | “Sorry, not today.” Every lender ever |

| 580–669 | Fair | Approved. But with rates that’ll make you cry |

| 670–739 | Good | You’re in the game, just not VIP yet |

| 740–799 | Very Good | Better rates, fewer headaches |

| 800–850 | Excellent | Red Carpet, Low Rates, and Lenders Fighting For You |

So yeah, your credit score matters a lot more than most people think. That’s why learning how to improve your credit score quickly isn’t just smart; it’s borderline essential.

The 9 Strategies That Actually Work (I’ve Tested Them All)

Look, I’ve tried the gimmicks. The Reddit threads. The “hacks.”

Most of them? Meh.

But these 9 strategies? They changed the game for me, and I’ve seen them work again and again for others too. If you’re serious about figuring out how to improve your credit score quickly, start here.

1. Pay Everything On Time, No Exceptions

I’ll be honest, this was my biggest screw-up when I started. I used to treat due dates like suggestions. “Eh, I’ll pay it tomorrow… or maybe next week.” That mindset cost me big time. One 30-day late payment dropped my credit score by 78 points overnight. I still remember refreshing the app and just staring at the number. I thought there was a glitch.

But there wasn’t.

Turns out, payment history makes up 35% of your credit score. And there’s zero forgiveness built into that formula.

Source: myFICO

So now, when someone asks me how to improve your credit score quickly, I don’t give them some flashy trick. I just say, :Don’t miss a payment. Ever.

Here’s how I fixed it (and never messed up again)

- 🔁 I put every single bill on autopay, even if it’s just the minimum.

- ⏰ I set two reminders on my phone: one three days before and one on the day.

- 💸 And yeah, I started paying twice a month, once mid-cycle and once just before the due date. It sounds extra, but it keeps me ahead.

Real talk: I’ve had months where money was tight. I couldn’t pay everything off in full, but I always made sure I paid something on time.

Even a small payment, made on time, keeps your score steady.

A big one, made late? That’ll set you back months.

2. Dispute Errors Like Your Financial Life Depends On It

I almost didn’t do this part, and I’m telling you now: don’t skip it. The first time I pulled my credit report, I was just curious. But then I saw three things that made my stomach drop:

A credit card I never opened

A “late payment” that I knew I paid on time

And a balance that was just… wrong

I thought, “Wait, how long has this stuff been messing up my score?” So I filed disputes, and 28 days later, boom: 43 points added to my credit score. Just like that. So yeah, if you’re serious about how to improve your credit score quickly, this is a step you can’t afford to ignore.

😬 Why This Happens More Than You Think

Would you believe that 1 in 5 people have errors on their credit reports? That’s not some Reddit rumor; that’s from the Federal Trade Commission. Source

That means if you haven’t checked yours yet… There’s a decent chance there’s some mess hiding in there.

🛠️ How I Cleaned Up My Report (and You Can Too)

1. 🔎 Went to AnnualCreditReport.com (It’s legit; don’t Google random credit report sites.) This one’s free and government-backed.)

2. 📝 I went line by line like a detective. “Is this mine? Is this correct?” Yeah, it took 30 minutes. But it was worth every second.

3. ⚡ I filed disputes directly online. Experian, Equifax, and TransUnion all let you do it in a few clicks.

4. ⏳ Then I waited… 30 days later, I got updates. Two items removed, one corrected. The score jumped, and I didn’t have to yell at anyone on the phone (miracle).

🚨 Red Flags to Watch For:

- 🧾 Accounts you don’t recognize

- ⏱️ Incorrect late payments

- 💰 Wrong balances or credit limits

- 🔁 Duplicate listings

- 📅 Old accounts that should’ve dropped off after 7 years

Quick Tip: Even one small error can drag your score down. Disputing it might feel like a hassle, but if you’re serious about learning how to improve your credit score quickly, this is non-negotiable.

3. Master the Credit Utilization Game (Trust Me, It’s a Game)

This is the spot where most people mess up, and I’m not going to lie, I did too.

For the longest time, I thought, “As long as I’m paying off my cards every month, I’m good, right?”

Yeah… no.

Here’s the thing no one tells you:

Credit utilization, which is how much of your available credit you’re using, makes up 30% of your score.

That’s nearly a third. And if you’re wondering how to improve your credit score quickly, this number right here can either carry you or crush you.

🔢 The Magic Numbers (And They Matter More Than You Think)

Let me break it down real quick:

I didn’t know any of this at first. I was out here maxing my card, thinking I’m doing adulting right just because I paid it off before the due date.

But nah, my score was stuck in place like gum on a sidewalk.

🛠️ Here’s What I Do Now (And It Works):

- 🕒 I pay before the statement closes, not just before the due date

- 💳 I make multiple payments through the month like a sneaky ninja avoiding high balances

- 🚨 And I attack the cards with the highest utilization first; that’s where the biggest gains are hiding

Real Example From My Life (Because Who Doesn’t Like Proof?)

I had this one card with a $2,000 limit.

Guess how much I had on it?

$1,800. Brutal. That’s 90% utilisation, and it was straight-up suffocating my score.

So I paid it down to $200 (10%).

And you know what?

And you know what? 52 points added in one month. No new account, no calls, no magic trick. Just basic credit math.

4. The Credit Limit Increase Hack: Your Score’s New Superpower 🦸♀️

By now, you know I’m going to talk about credit utilisation (that old chestnut). But here’s something you maybe didn’t know: you don’t have to pay down your balance to drop it; you can just increase your credit limit instead.

In my experience, this is one of the smartest ways to figure out how to improve your credit score quickly without spending a cent.

💡 Why It Works (and Source-Backed)

- Boosting your credit limit lowers your utilisation ratio instantly, which can hike your score. According to LendingTree, getting a limit increase “could potentially improve your credit score by lowering your credit utilisation ratio. LendingTree/Chase

- Most companies use soft pulls; they don’t ding your credit, especially if you’ve been consistent with payments. Capital One confirms this in their guidance, Capital One.

- Reddit users agree: “If the card issuer is offering the CLI, it’s likely not a hard pull, so there’s no downside, so long as you don’t change your spending or payment habits.” Reddit

My “Lazy Genius” Blueprint

- Every 6–12 months, I request an increase online, no awkward phone calls.

- I usually ask for 2–3× my current limit. They counter, and I accept.

- I never touch the new limit. It sits there doing the work, while my utilisation drops.

⚠️ The Real Talk Warning

This hack is golden… only if you don’t spend the extra credit.

A $5K limit can be a tunnel to temptations.

If you see it, you might feel you can spend it, and that’s where the trap is.

📊 Quick Pro Insight Chart

| Credit Limit | Same Spending | Utilization ↓ | Score Potential |

|---|---|---|---|

| $2K → $5K | $500 | Drops from 25% to 10% | Score boost likely |

🎯 When You Shouldn’t Do This

- You’ve got a big loan coming up (mortgage, auto)—multiple hard inquiries or a sudden jump in available credit can raise red flags. Citi+2Chase+2Ally+2en.wikipedia.org+1Real Simple+1MarketWatchInvestopedia+3Citi+3LendingTree+3.

- You’ve got a history of overspending. If temptation is real, skip this for now.

🧠 Fresh Tip: Track Score Changes

Use CreditWise by Capital One or Experian’s simulator to see how your utilisation shift affects your score before asking for an increase, LendingTree+8Capital One+8Chase+8. Gives you confidence and avoids surprises.

Bottom line:

If you can handle discipline, raising your credit limit is a no-brainer move for anyone asking how to improve your credit score quickly. Zero spending. Zero hassle. Real results.

5. The “Piggyback” Trick That Changed Everything

Look, when my little brother turned 21, his credit was a clean slate not bad, just blank. No cards, no loans, nada. And we both knew that in today’s world, that’s almost as limiting as having bad credit.

So I pulled a move I wish someone had done for me years ago:

I added him as an authorized user on my oldest credit card.

No paperwork. No hard inquiry. No need for him to even touch the card.

And guess what? Four months later, his score? 720. No joke.

So what actually happened here?

Basically, when you’re added as an authorized user, the bank lets your name ride along on someone else’s good behavior. You get the benefit of:

- Their long account history

- Clean payment track record

- A well-managed card that shows you’re “responsible” (even if you didn’t earn that part yet)

and i am happy to tell you, my friend Sarah’s sister added her to a 9-year-old card. Sarah didn’t touch it once, and her score jumped 89 points in 6 weeks.

6. Whatever You Do… Don’t Cancel That Old Card

Okay, confession time:

When I got approved for my first real credit card, the kind with points, perks, and that fancy metal feel,

I got a little cocky. I looked at my dusty old student card and thought, “Pshh, why do I even still have this?”

I was this close to closing it… until my mentor straight up told me,

“Dude. That card is the reason your credit score isn’t trash. Keep it.”

And he was right.

Shutting down old cards is like torching part of your credit history. You lose two important things in one dumb move:

- You lower your total available credit (which messes with your credit usage % and yep, that matters a lot)

- You shorten your average account age, which is 15% of your score. Who knew?

What I do now (and you should too):

🧾 I throw tiny autopay charges on my old cards like Spotify or random app subscriptions

🔒 I stash the actual cards in a drawer so I don’t end up buying sneakers with them

🧠 And I never, ever close them unless they’re charging me a dumb annual fee (and even then, I ask if they’ll downgrade it to a free version)

Seriously, that old $500-limit card from college? It’s now my quiet little credit hero in the background. Doesn’t brag. Just keeps my score steady.

Remember that: Just because a card is boring doesn’t mean it’s useless. Sometimes, boring is exactly what your credit score loves.

7. Smart Credit Mix Without Going Overboard

I used to think having one good credit card was enough. And honestly, in the beginning, it kinda is.

But over time, I learned that credit scoring models like it when you juggle different types of accounts responsibly, of course.

In my case, it happened naturally:

- I started with a basic credit card

- Took out an auto loan when my old car gave up

- Eventually got a mortgage

- Added another card just for travel rewards

The key is organic growth. Don’t go applying for loans you don’t need just to “look good” on paper. But if you do take out a legit loan, say, a car or student loan, it can help your score in the long run.

Here’s a quick breakdown of how different types of credit accounts play into your overall mix:

🔄 Credit Mix at a Glance

| Type | Example | Category |

|---|---|---|

| Credit Card | Chase Freedom, Amex Blue | Revolving Credit |

| Auto Loan | Car financing | Installment Loan |

| Mortgage | Home loan | Installment Loan |

| Student Loan | Education financing | Installment Loan |

| Personal Line of Credit | Emergency funds | Revolving Credit |

🧠 Heads up: Your credit mix only makes up about 10% of your score, so don’t stress over it. Just don’t be the person who only has one maxed-out credit card and nothing else.

Think of it like a balanced diet. You don’t need everything at once, but variety helps over time.

Pro tip: Don’t open new accounts to “diversify.” Let your credit profile grow with your real-life needs.

If you need a loan, fine. But don’t force it.

📎 FICO explains credit mix here

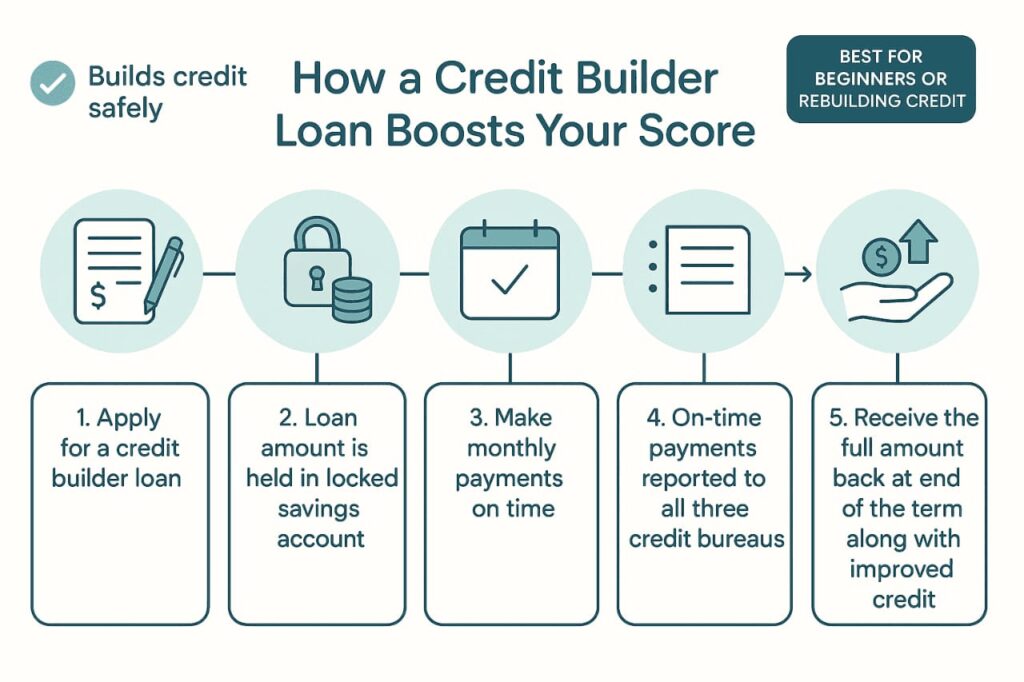

9. The Underrated Lifesaver: Credit Builder Loans

Let me tell you about my cousin Jay. After a rough bankruptcy, he couldn’t get approved for anything, not even a secured credit card. Every door was slammed shut… until he stumbled onto something called a credit builder loan.

At first, we thought it was some kind of scam. But nope, it was legit. And it worked.

So, what is a credit builder loan?

It’s kind of like tricking the system… in a good way.

- You “borrow” $500–$1,000

- But instead of getting the money upfront, it’s locked in a savings account

- You make small monthly payments for 12 to 24 months

- Those payments get reported to all three credit bureaus

- At the end, you get your money back and a better credit score

Jay saw a 65-point jump in less than six months. No joke.

🎯 Why it works:

Because it builds payment history and adds a new type of credit to your profile without the risk of overspending. Win-win.

And if you’re wondering how to improve your credit score quickly when nobody will give you a chance, this strategy could be your golden ticket.

💡 Bonus Tip: Check out Self or your local credit union. Some even let you choose your payment amount to fit your budget.

Track Your Score Like a Hawk 🦅

One of the easiest ways to improve your credit score quickly? Start tracking it regularly.

I used to ignore mine for months out of sight, out of mind. Big mistake. Now I check it every Sunday, like clockwork. Why? Because what you measure, improves.

💡 Here’s a quick side-by-side of the top tools I’ve used to track and improve my score fast:

Pro Tip:

If you’re serious about learning how to improve your credit score quickly, use at least two tools together one that shows your VantageScore (like Credit Karma), and one that gives your actual FICO score (like Experian).

📚 You Might Also Like

🎯 Made it this far? That means you’re serious about improving your credit, and I respect that.

Here are a few handpicked resources I recommend (some saved my financial life):

- How to Start a Portfolio with No Experience: 5 Steps to Get Started from Scratch (2025)

- How to Save Money Fast (Without Feeling Like You’re Missing Out)

- The Stock Market Guide for Beginners Is Like a Supermarket: A Beginner’s Global Guide to Investing

- How to get out of student loan debt (2025)

- Top 10 Student Loan Management Tips for Graduates:(2025)

📌 Frequently Asked Questions (FAQ)

How fast can I improve my credit score?

In some cases, you might see improvement in as little as 30 days especially if you’re correcting errors or paying down high balances. But for most people, a meaningful jump takes 2–3 months of consistent action. The key is knowing which levers to pull like lowering utilization, disputing mistakes, or becoming an authorized user.

What’s the quickest way to improve my credit score?

Honestly? There’s no one-size-fits-all trick, but here are three quick wins:

Dispute errors on your report (you’d be shocked how common they are)

Pay down cards to below 10% usage (huge impact)

Ask for a credit limit increase (increases total credit without new debt)

If you’re wondering how to improve your credit score quickly, start with those three. They work I’ve tested them.

Will checking my credit hurt my score?

Checking your own credit (called a soft inquiry) won’t hurt your score at all. You can check as often as you like through platforms like Credit Karma or AnnualCreditReport.com.

Only hard inquiries like applying for new credit — can ding your score slightly.

Should I close old credit cards I’m not using?

Nope. Unless there’s a really good reason (like fees), keep them open. Closing old cards reduces your total available credit and lowers your average account age both of which can hurt your score.

Is it true that paying twice a month helps?

Yes, especially if you’re trying to lower your reported balance before the statement date. Even if you pay in full each month, splitting your payments can keep your credit utilization low throughout the month which can help your score reflect better behavior.

Pingback: 7 Smart Ways to Use a Mortgage Calculator Before You Buy a Home

Pingback: Tax Season Made Simple: A Beginner’s Guide to Filing in the U.S