You’ve probably noticed that U.S. mortgage rates in 2025 are still near multi-year highs. Honestly, it’s been a crazy ride. One day you hear, “Rates will probably drop soon,” and the next, you find out… nope, they’re still on the rise.

The thing is, refinancing isn’t always the magic bullet. The sky-high closing costs, a less-than-perfect credit history, or the simple fact that current rates aren’t much better than your old ones can make it more of a headache than a solution.

So, if you’re wondering how to lower your mortgage payments fast without refinancing, you’re in the right place. I’ve felt that frustration myself and found there’s no way out. But don’t worry. In this post, I’ll share some smart, practical tips that can actually reduce your monthly bill without the complicated loan process that takes months. Let’s get started.

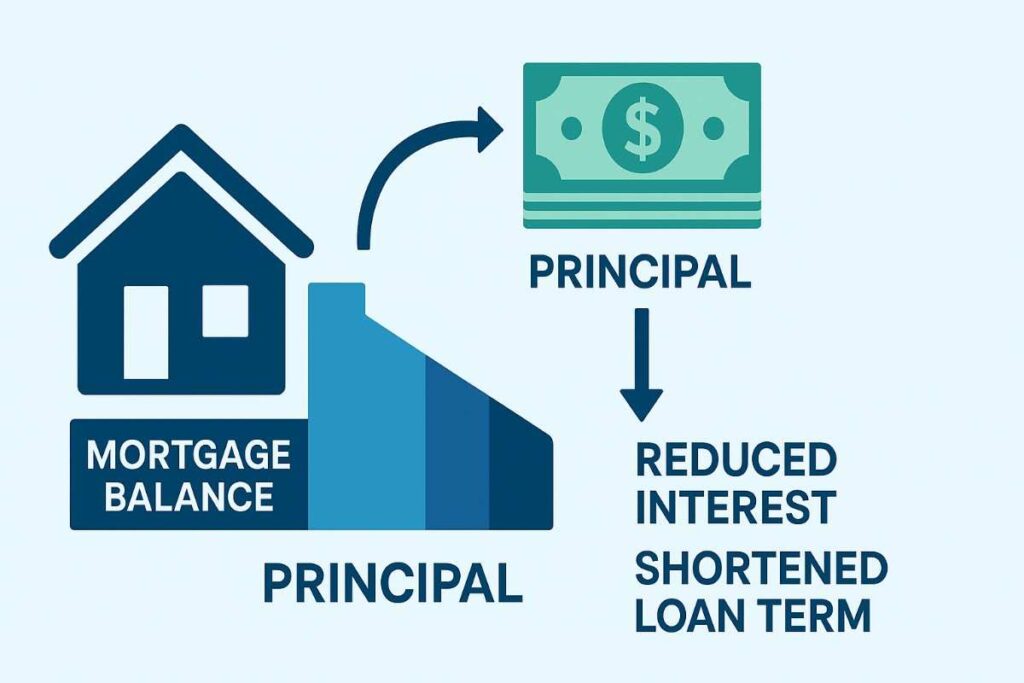

1. Pay Down the Balance with Extra Payments

Okay, I know what you’re thinking: “If I had extra cash, I wouldn’t be stressed about my mortgage.” Fair point. But hear me out: even a small extra payment can make a huge impact.

Here’s the deal: every dollar you put toward your principal (the original amount you borrowed) reduces the total interest you’ll pay over the life of the loan. And that interest? That’s the hidden component that makes your payments so heavy.

I’ll share a small experiment of my own: I started paying just $100 extra toward my principal each month. It wasn’t a big deal. Over time, that single move saved me thousands of dollars in interest and cut years off my repayment time. It felt like I found a cheat code for my mortgage.

If your goal is to pay off your mortgage faster without refinancing, this is one of the easiest ways to do it. No phone calls to the bank, no paperwork hassles, you’re just quietly beating the system and getting closer to your goal with every payment.

2. Request a Loan Recast

If you’ve never heard of a “loan recast,” you’re not alone. It’s one of those low-profile tricks your lender isn’t in a hurry to tell you about. And you should know, it’s completely different from refinancing.

The concept is simple: in a mortgage recast, you make a large lump-sum payment toward your loan’s principal, perhaps from a work bonus, an inheritance, a tax refund, or by selling that second car you rarely drive (so whatever). Then, your lender recalculates your monthly payments based on that new, smaller balance. Your interest rate stays exactly the same, but your monthly bill goes down.

More details here: What Is Mortgage Recasting and Why Do It?.

Why is this so powerful? If you’re looking for how to lower your mortgage payments fast without refinancing, a recast can give you results in just a few weeks instead of months. And it doesn’t involve mountains of paperwork, credit checks, or the thousands of dollars in closing costs associated with refinancing.

A Quick Look:

| Feature | Loan Recast | Refinance |

|---|---|---|

| Changes Interest Rate | No | Yes |

| Requires Lump Sum | Yes | No |

| Typical Cost | $200–$500 fee | 2–5% of loan balance |

| Time to Take Effect | 1–2 months | 1–2 months (plus more steps) |

In my experience, this works best when you get a financial windfall and you want a little breathing room immediately without changing your loan terms. There’s just one “catch”: you need to have that lump sum ready. But if you do, it’s one of the smoothest moves you can make.

3. Eliminate Private Mortgage Insurance (PMI)

If you bought your home with less than a 20% down payment, chances are you’re paying PMI every month and maybe not even paying much attention to it. But here’s the thing: PMI is basically a “rental” fee for your lender’s peace of mind. It’s their protection, not yours, and it can quietly siphon $50 to $200 from your budget each month. Consumerfinance.gov

For conventional loans, once you build 20% equity in your home (either by paying down the loan or by the home’s value increasing), you can request that your lender remove the PMI. And yes, this is possible without refinancing, making it a solid option if you’re thinking about how to lower your mortgage payments fast without refinancing. So here is an example for you.

Let’s say you owe $240,000 on your loan, and your home is now worth $300,000. That’s exactly 20% equity. You call your lender, provide proof (sometimes they’ll require an appraisal), and just like that, the $150-a-month PMI disappears. That’s $1,800 a year back in your pocket.

Pro Tip: Don’t wait for your lender to automatically remove PMI at 22% equity. As soon as you hit 20%, call them to make it official. The sooner you do it, the more you’ll save.

4. Appeal Your Property Taxes

This is a tip that many homeowners don’t know about, your property tax bill isn’t always fixed. In most U.S. counties, the tax you pay is based on the assessed value of your home. If that number is higher than your home’s actual market value, you might be overpaying.

The good news is you can challenge it. This is called a property tax appeal, and it’s one of the sneaky ways you can quickly lower mortgage payments without refinancing.

How it works:

How it works:

- Check your assessment notice: Counties typically send these out once a year.

- Look for errors: Incorrect square footage, extra bathrooms that don’t exist, or inflated comparable sales.

- Gather evidence: Recent appraisals, photos, or sales data for similar homes in your neighborhood.

- File your appeal: Each county has its own process and deadline (often 30–90 days after receiving the assessment notice).

- Attend the hearing: If necessary, present your case like you’re defending your favorite pizza topping. Calm but convincing.

Savings potential: For many U.S. homeowners, a successful appeal can reduce the tax bill by $500 to $1,500 per year, which directly lowers your monthly escrow payment. According to some county records, when you have solid evidence, the success rate is surprisingly high (often 20–40%).

It takes a little homework, but this is one of those moves where a few hours of effort can save you money for years.

5. Switch to Biweekly Payments

This is a small trick that sounds incredibly simple: instead of making one full mortgage payment a month, cut it in half and make a payment every two weeks. No refinancing, no new loan, just a small tweak to your payment schedule.

How does this work? There are 52 weeks in a year. Paying every two weeks means you make 26 half-payments a year, which adds up to 13 full payments instead of 12. That extra payment goes straight to the principal, paying off your mortgage faster and saving a significant amount of money in interest, all without refinancing. Bankrate.com

Example: If you have a $300,000 loan at 6.5% for 30 years, switching to biweekly payments can cut off nearly 4 years of time and save over $40,000 in interest. And this can all be done without touching the interest rate or going through the pain of refinancing.

Pro Tip: Before you start, confirm with your lender that they apply payments as they come in. Some lenders will hold extra payments until the end of the month unless you specify that they should go toward the principal.

If you’re looking for how to lower your mortgage payments fast this is one of those “set it and forget it” moves that quietly works in the background.

6. Rent Out a Portion of Your Property

If you have extra space, like a basement, a guest room, or even an ADU (Accessory Dwelling Unit) that space can help pay your mortgage for you. No, not everyone wants to share their home, but if your goal is how to lower your mortgage payments fast without refinancing, renting out the space is one of the most direct ways.

Two basic approaches:

- Long-term rental: A regular tenant who pays rent every month. It’s stable, makes budgeting easy, and requires less day-to-day work. Perfect if you prefer stability over flexibility.

- Short-term rental (like Airbnb or VRBO): The monthly income can be higher, especially if you’re in a high-demand area, but it comes with more work in turnover, cleaning, and management.

Example: Let’s say you rent out your finished basement for $900 a month. That’s $10,800 a year, which for many U.S. homeowners, can cover a large portion or even all of their mortgage payment. In some cities, a well-managed short-term rental can double that amount.

Pro Tip: Check your city’s rental regulations and HOA rules before listing. If you’re doing a short-term rental, invest in good furniture and professional photos—presentation is everything.

7. Review and Lower Your Homeowners Insurance

This is a move that many people forget. If your homeowners insurance premium is escrowed, it’s part of your monthly mortgage payment. This means if you can lower your insurance cost, you can lower your total mortgage payment without changing your loan. If you’re looking for how to lower your mortgage payments fast without refinancing, I think this is a pretty neat trick.

- Step 1: Shop around at least once a year. Rates can change for many reasons; maybe your credit score has improved, your area’s risk level has been reclassified, or a competitor wants your business.

- Step 2: Check for bundling discounts. If you have homeowners and auto insurance with the same provider, you can save up to 10–20%. On a $1,500 annual policy, that’s $150–$300 back in your pocket.

- Step 3: See if you’re over-insured. I once realized I was paying a premium to cover “replacement costs” for features that my home didn’t even have. Cutting unnecessary coverage instantly lowered my premium without increasing my exposure to real risks.

Just be careful: Don’t cut essential coverage. It’s not worth saving $20 a month if a disaster leaves you in serious financial trouble.

8. Negotiate with Your Lender or Servicer

I know, “calling the bank” doesn’t sound like a fun time. But the truth is, sometimes a simple phone call can save you more money than all the coupons in the world. And yes, if you want the best solution to quickly lower mortgage payments without refinancing, it’s entirely possible.

When it makes sense:

- You’ve had a temporary financial setback (job loss, medical bills, unexpected expenses).

- Your interest rate isn’t terrible, but the monthly payment is stretching your budget.

- You’ve been a reliable payer and have a good relationship with the lender.

What to ask for: - Payment restructuring: Spreading the remaining balance over a longer term (without changing the interest rate).

- Temporary payment reduction: You pay less for a while so you can recover financially.

- Forbearance: Pausing payments for a period (but remember that these missed payments get added on later).

Pro Tip: Before you call, decide exactly what you want. If the goal is to save $200 a month, state that directly. Lenders get thousands of calls a day; the clearer your request, the higher the chance they’ll help.

Real talk: I’ve personally seen people save $150–$300 a month just by explaining their situation and showing they want to stay current on their payments. Banks don’t want foreclosures; they’re expensive for them, too. Sometimes giving you a little breathing room is the best option for everyone.

9. Conclusion

Look, I get it. When you see that monthly mortgage bill, it can feel like you’re tied to it for life. And yes, refinancing is always in the news, but it isn’t your only option. From making small extra payments to eliminating PMI, from loan recasting to appealing property taxes, there are plenty of ways to make it easier to breathe without refinancing. You’ll find more of these on this site in the future.

My advice is to start as soon as possible. The best time to start is right now, not next month or when rates “finally drop.” Because every payment you make without a plan is money you could have saved. And who doesn’t want a little more room to breathe in their budget?

If you want to know about the mortgage calculator in detail, click here.

Frequently Asked Questions: How to Lower Your Mortgage Payment FAST Without Refinancing

What is a loan recast and how does it work?

Imagine you get a surprise work bonus, a tax refund, or maybe you sell that old car sitting in your driveway. Instead of splurging on a vacation, you throw that chunk of cash at your mortgage principal. Your lender then recalculates your payment based on this new, lower balance, same interest rate, same loan term, just a smaller monthly bill.

It usually costs a small fee ($150–$500), and it’s much less hassle than refinancing.

As one homeowner shared on Reddit:

“I recast my loan for $200. My monthly payment dropped from $1,700 to $1,150. Best money I ever spent.”

Can I remove Private Mortgage Insurance (PMI) without refinancing?

Yes. Once you’ve built at least 20% equity in your home (meaning your loan balance is 80% or less of your home’s value), you can request your lender to remove PMI.

Here’s a quick example:

If you owe $240,000 and your home is worth $300,000, you’ve hit exactly 20% equity. Call your lender, ask about removal, and you could instantly save $100–$200 a month. Don’t wait for the automatic removal at 22% that’s like waiting for a bus when you could already be home.

How does appealing property taxes help lower my payment?

Your property taxes are based on your home’s assessed value. If the county thinks your house is worth more than it really is, you might be paying too much.

By filing a property tax appeal with evidence (like recent appraisals or sales data from similar homes), you could lower your annual tax bill, which lowers the escrow portion of your monthly mortgage payment.

I’ve seen homeowners save $500–$1,500 a year from a successful appeal. One friend told me,

“It took me two hours to gather the documents, and now I save $110 a month. That’s my utility bill covered.”

Will switching to biweekly payments actually save money?

YES, and it’s sneaky simple. Instead of making one monthly payment, you make half a payment every two weeks. Because there are 52 weeks in a year, you end up making 13 full payments instead of 12. That extra payment goes straight to your principal.

Over time, this can shave off years from your mortgage and save tens of thousands in interest. For example, on a $300,000 loan at 6.5% over 30 years, you could cut almost 4 years and save over $40,000.

What’s the difference between loan modification and forbearance?

Forbearance is like hitting “pause” your lender temporarily reduces or suspends payments while you recover from a hardship, but you still owe that money later.

Loan modification is more permanent, your lender changes the loan’s terms, like lowering the interest rate, extending the term, or even reducing the principal.

Think of it this way: forbearance is a short-term break, modification is a long-term diet plan for your mortgage.

Can changing my homeowners insurance or loan term help?

Absolutely. If your homeowners insurance is part of your escrow, shopping around for a better rate can directly lower your mortgage payment. Even bundling home and auto insurance can save you 10–20%.

Changing your loan term (through modification, not refinancing) can lower your payment too, but remember, it often means paying more interest over time.

Is making extra mortgage payments worth it?

Yes, but it’s about consistency, not size. Even $50–$100 extra each month toward principal can knock years off your loan and save you thousands in interest.

A homeowner once told me:

“I started adding $75 to my payment every month. It felt like nothing… until I realized I’d paid off my 30-year loan in just under 25 years.”

Pingback: Tax Season Made Simple: A Beginner’s Guide to Filing in the U.S