1. Introduction: Why should you have a family?

Have you ever thought that a single $100 seems like a lot in one country and nothing like it in another?

Let me tell you a small story of mine. Last year I planned a short trip to Mexico. I was going to Mexico for the first time. I checked the bank app, and everything was fine. Flights were booked. Airbnb was also affordable. But when I reached there and exchanged a few dollars into pesos, I was surprised. At first I felt that maybe I made a mistake.

Because I got a lot more pesos than I expected. Then I came to know that the exchange rate (or what they call Tipo de Cambio) had completely changed in my case.

2. 💬 What Does “Tipo de Cambio” Actually Mean?

Let’s understand this without getting into any technical matters.

Tipo de cambio” is just Spanish for “exchange rate. By the way, we should also know how the exchange rate works.

Whenever there is trade between two countries or people travel, currency has to be exchanged. This exchange depends on market demand and supply, political stability, central banks, and economic performance.

📌 Types of Exchange Rate Systems

- Fixed Exchange Rate

The government or central bank controls the rate (e.g., the Saudi Riyal is pegged to USD). - Floating Exchange Rate

The rate keeps changing according to market forces (demand-supply) (e.g., USD, Euro, RMB).

Example:

💶 1 USD ≈ 18.85 or 18.90 MXN

💵 1 USD ≈ 0.86 EUR, so this is your Tipo de cambio

3. How are exchange rates determined?

- Due to floating vs fixed systems, most currencies change daily.

- Central bank policies—like Fed or ECB decisions—affect everything.

- Inflation & stability—Where there is instability, the currency becomes weak.

- Global sentiment—When there is uncertainty in the world, people invest in dollars, which makes the dollar strong.

4. Real-Life Effects: What does it mean for you?

- Travel—Mexico, Europe, Japan… The difference in exchange rate changes your daily budget.

- Remote workers & freelancers – The income you earn in USD can be more or less valuable where you live.

- Investments—Foreign stocks, EETFs, and crypto are linked to currency movements.

- Online shopping—Non-USD platforms often charge hidden exchange charges.

5. 🔍 2025 Exchange Rate Trends – USD–MXN & USD–EUR

Currency Pair 2025 Average High/Low

| Currency Pair | 2025 Average Rate | 2025 High | 2025 Low |

|---|---|---|---|

| USD–MXN | 21.18 MXN(Feb 2) (Exchange Rates UK, Exchange Rates) | 21.18 MXN (Feb 2) (Exchange Rates UK, Exchange Rates) | 18.53 MXN (Jul 27) (Exchange Rates UK, Exchange Rates) |

| USD–EUR | ~0.906 EUR per USD (poundsterlinglive.com, xe.com) | 0.9826 EUR (Jan 13) (poundsterlinglive.com) | 0.8453 EUR (Jul 1) (poundsterlinglive.com) |

How to understand:

If you converted USD to pesos at the start of 2025, you would have gotten ~21 pesos—while in July you got only ~18.5. This means you get 10–15% fewer pesos.

In the case of EUR, the value of USD started at ~0.98 EUR but later fell to ~0.85—meaning you are getting back more dollars than you got from euros earlier. REUTERS /Exchange Rate/Tradingeconomics

6. Travel Trends & News Highlights

- U.S. travellers benefit from a strong dollar when they go to Europe. EUR/USD has fallen from ~1.12 to ~1.03 since late 2024, making spring vacations cheaper. Businessinsider/Nypost

- But US–EU trade tariffs created confusion in the market. The euro first fell to ~$1.15, then bounced back strongly due to some policy changes. Investors are still unsure about what will happen next. REUTERS

7. Tools & Tips: Always keep a standard

Most recommended:

- Wise, Revolut, XE, Google, OANDA

- Use mid-market rates to get a better comparison

- Don’t exchange at airports; fees are high

- Always be aware of hidden charges, especially in online payments

How to take smart financial decisions in a volatile currency market?

- Observe the rate for a few days before big transactions

- Make big purchases or transfers when your currency is strong

- If you deal frequently in USD, consider hedging

- Diversify your portfolio—USD, EUR, crypto if you are an expat

- Put a buffer in the budget; there can be a swing of 3–5%

9. Final Thoughts: Always Be Curious and Smart

Exchange rates (Tipo de cambio) The type of currency is not just numbers. These decide how far your money goes. Smart timing, the right tools, and awareness can turn small shifts into meaningful savings for you.

I myself have lost money by converting mid-week when I didn’t check the rates—and saved more money the next time by just waiting for a few days. That’s why understanding the exchange rate is not optional; it’s part of smart money living.

Some things are very important for you to know, and these things will enhance your experience even more.

1️⃣: Hidden Fees: How do platforms hide the real type of marketing

You already know that mid-market rates (which are the real “type of marketing”) are the fairest. But see how platforms change:

| Provider | Mid‑Market Rate* | Typical Rate You Get | Effective Fee |

|---|---|---|---|

| Wise | 1 USD = 0.91 EUR | ~0.910 EUR | ~0% (transparent fee) (Wise, PhotonPay) |

| PayPal | 1 USD = 0.91 EUR | ~0.88 EUR | ~3–4% markup over mid‑market (PhotonPay, Curve, Reddit) |

Thing to understand: PayPal and many banks charge their own rates, which gives you less money. These are hidden fees that you don’t see directly.

2️⃣: Tax Matter: When IRS is Concerned

If you are earning, spending, or investing in foreign currencies… then the IRS should know.

- The IRS says that all U.S. taxpayers have to report foreign currency income and convert it to USD at a consistent exchange rate.

- Transactions in any currency other than USD fall under IRC Section 988, where FX gains/losses are considered ordinary income, not capital gains… unless you specifically choose something else.

- If your FX gain or loss is less than ~200 USD and it is for personal use (e.g., vacation cash), you most likely will not have to pay taxes.

Helpful Tip: Always keep a record of FX transactions, note rates and dates, and if you deal in currency regularly or in large amounts, be sure to talk to a tax expert.

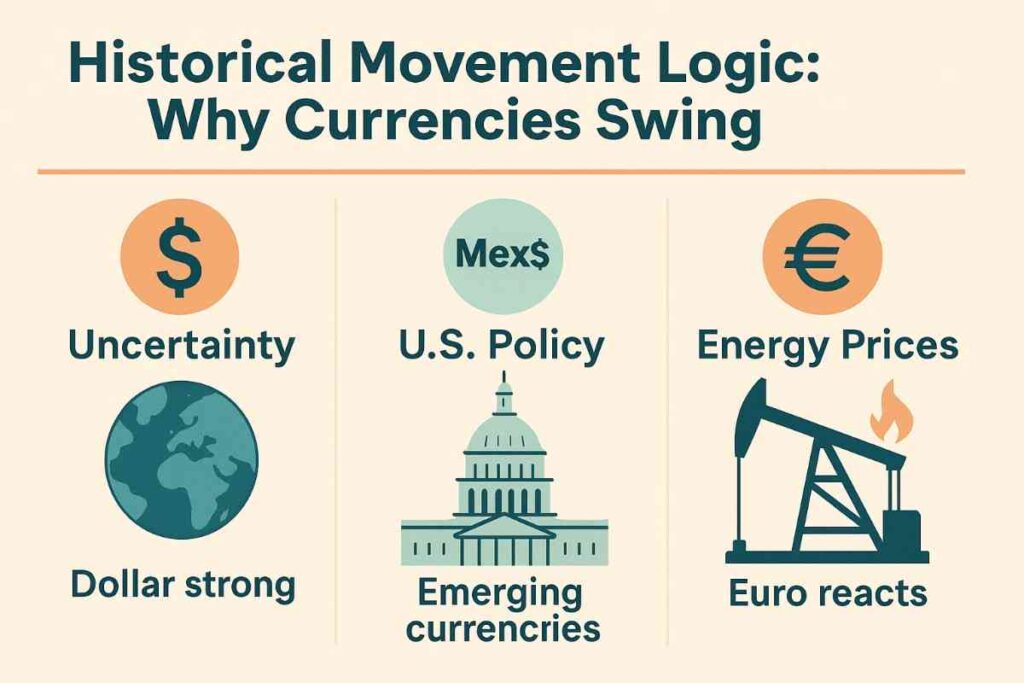

3️⃣: Historical Movement Logic: Why Currencies Swing

“Tipo de Cambio” doesn’t just change.

There are certain factors that influence the market.

- The Type Cambio does not move randomly. Here are the things that drive markets:

- The dollar is strong when there is a lot of uncertainty in the world, even if the U.S. economy is weak.

- Emerging currencies (such as MXN) are sensitive to U.S. policy, import/export, oil, and tourism flows.

- The euro reacts largely to energy prices (Russia, Middle East) and Eurozone elections.

I think if you understand these trends, you can predict exchange rates pretty easily.

4️⃣: Cheatsheet: What to Do When the Tipo de Cambio Moves

You can use this guide according to your situation.

| If You’re… | If USD is strong, convert beforehand |

|---|---|

| Travelling to Europe | If USD is strong = convert beforehand |

| Living in a foreign country, earning USD | If USD is weak, delay conversion (if possible) |

| Doing freelance for US clients but abroad | Send invoices when USD is high |

| Investing in foreign ETFs/crypto | My advice is to hedge if rates go too up/down |

| Opening a foreign savings/investment account | Keep a record of FX; it can be important for the IRS. |

☑️ Final Thoughts:

I hope now you will have a clear idea of what the real exchange rate is, how platforms hide fees, what the tax rules are, and what strategy should be adopted when the rate moves.

10. FAQs Mostly asked question

1: Is a strong dollar good?

If you are travelling or spending money abroad, then yes. But if you are earning in some other currency and converting it to USD, then it can also be a disadvantage.

2: Why do different platforms show different rates? (Tipo de cambio)

Because they charge a markup. The real rate is the mid-market rate, which is available on XE or Google

3: What is the best time to convert money?

It is smoother in the middle of the week (Tuesday–Thursday). Rates freeze on weekends.

4: Should you pay in USD or local currency?

If you are earning USD and the local currency is weak, then USD is best, but always count the conversion fees.