You’ve worked hard all year, and just like clockwork, it’s that time again: tax season. You’ve got your payslips, you’ve bought that coffee that was probably more expensive than the gas in your car, and now it’s time to deal with Uncle Sam.

If you’re in your 20s or early 30s, this might be your first or second time filing on your own. I still remember sitting in front of my laptop back in 2022, staring at a Form 1040 and wondering if I should just move to a deserted island. It was pretty rough, believe me. So, let’s get into the topic.

Why the Federal Government Wants Your Money

Think of yourself as part of a huge society where everyone contributes so that big things can get done. We’re talking about things like funding the military, building highways, providing retirement benefits, and offering healthcare services.

“Federal” means the national level, the government in Washington, D.C. This is a separate system from your state government (which manages its own stuff like local schools, police, and state roads).

You can think of it like layers of a cake:

- Top layer (federal): Country-level work.

- Bottom layer (state): State-level work.

Do You Need to File? (Probably Yes)

Every year, the IRS (the tax department) sets a minimum income threshold. If your income is higher than that amount, filing a tax return is mandatory.

For example, let’s say the threshold is $28,000. If you earned $27,999, you wouldn’t owe any federal income tax. But if you earned $28,001, you’d be required to file.

Let’s use a different example to explain it better. The US tax year is from January 1 to December 31. The following year, around April 15, you file your tax return. On this return, you’ll calculate:

- Your total income.

- How much tax were you supposed to pay?

- How much you’ve already paid (through withholding or estimated payments).

Based on this, there are two possible results:

- If you paid too much → You get a refund.

- If you paid too little → You have to pay the remaining amount.

Your Filing Status Matters More Than You Think

- Single: You’re unmarried, divorced, or legally separated (obviously).

- Married Filing Jointly: You and your spouse combine your income and file one return. This usually offers the most benefits.

- Married Filing Separately: This can be beneficial in some cases, like with student loan repayment plans.

- Head of Household: You’re unmarried, but you financially support a dependent. This status gives you a higher standard deduction.

Hopefully, this concept is clear now.

Don’t just assume “single.” If you support someone (even your parents), check the rules. You might be able to save a decent chunk of money.

The Progressive Tax System: Not All Your Money Gets Taxed the Same

I’ve seen many people say that if you move into a higher tax bracket, your entire income is taxed at that higher rate. That’s a myth, so let me explain.

Think of it like climbing a staircase. The first few steps are cheap. The higher you go, the more expensive the next steps become, but the rate for the lower steps stays the same.

Example:

- The first $10,000 of your income is taxed at 10% → $1,000 in tax.

- The next $20,000 is taxed at 12% → $2,400 in tax.

The money that goes above a certain amount gets hit with the next rate. This means that if you’re earning $40,000, your entire $40k isn’t taxed at the highest rate. Only the income that falls into each bracket is taxed at that bracket’s specific rate.

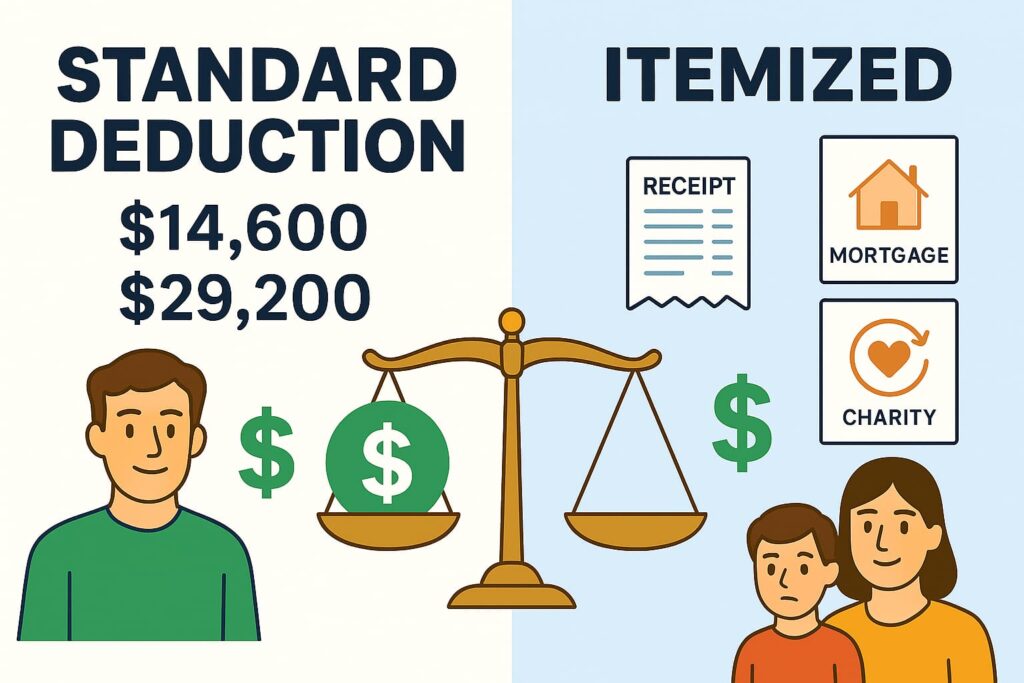

Standard vs. Itemized Deductions: The Big Choice

For 2025, the standard deduction is:

- Single: $14,600

- Married Filing Jointly: $29,200

Most young filers choose the standard deduction because it’s simple and often saves them more money. You’ll only itemize if your deductible expenses (like mortgage interest, state taxes, or large charitable donations) add up to more than the standard deduction.

Credits You Don’t Want to Miss

Credits are a whole different ballgame; they reduce your tax bill dollar-for-dollar. A few important ones are

- Earned Income Tax Credit (EITC): For low- to moderate-income individuals.

- Child Tax Credit: For children under 17 years old.

- American Opportunity Credit: Helps with college expenses.

How to file taxes online for FREE (IRS Approved Methods)

1. IRS Free File Program

If your income is $79,000 or less, you can use the IRS Free File software.

It walks you through the process step by step and automatically fills out the forms for you. Super simple.

2. Free File Fillable Forms

If you make more than $79,000, you can still file for free using Free File Fillable Forms.

The catch? You’ll need to fill out the forms yourself, which can get a little technical. This option works best if you’re already comfortable with tax forms.

3. Volunteer Income Tax Assistance (VITA) & TCE

If your income is $64,000 or less, or if you’re a senior, you may qualify for free help through the VITA and TCE programs.

Trained volunteers will actually file your taxes for you at no cost. You can search for a center near you right on the IRS website.

4. IRS Direct File (New Program)

Starting in 2024, the IRS rolled out a new option called Direct File.

It’s 100% free, but currently only available in a handful of states. With this option, you file directly on the IRS portal, no middleman needed.

IMPORTANT TIPS

- Tax season usually runs mid-January through mid-April.

- Filing early = faster refunds.

- Always keep your W-2s, 1099s, and receipts handy before you start.

My Final Take

Taxes might not be “fun,” but they’re a life skill you should learn sooner rather than later. The more you understand the system, the less stressful it becomes. Think of it as a yearly financial checkup: get your position, file the paperwork, and move on with your life.

And hey, once you’re done, reward yourself. Treat yourself to a nice dinner or those new sneakers you’ve been eyeing. You’ve earned it.

Useful Links

- How to Lower Your Mortgage Payments Fast Without Refinancing

- Mortgage Calculator: The Simplest Way to Figure Out Your Home Loan Payments

- How to Improve Your Credit Score Quickly: My Journey from 520 to 780 (And How You Can Too)

Frequently Asked Tax Questions

How can I lower my tax bill?

Think of it this way: every dollar you put into a 401(k) or IRA, HSA, or FSA is like giving your future self a little gift and shrinking your tax bill today. Pretty sweet, right? On top of that, credits like the Child Tax Credit cut down your taxes directly. And hey, if you’ve got a side hustle or small business, don’t forget you can deduct legit business expenses too (Schedule C instructions).

What deductions do I qualify for?

Almost everyone gets either the standard deduction (for 2025 it’s $14,600 if you’re single, or $29,200 if you’re married filing jointly) or itemized deductions. Itemizing can cover things like student loan interest, mortgage interest, state/local taxes, and qualified medical expenses. Basically, whichever gives you the bigger break is the way to go.

What’s the difference between a marginal and effective tax rate?

Your marginal rate is the tax rate on your last dollar earned, your top bracket. But your effective tax rate is more like the big picture: total tax divided by total income. In other words, marginal is what you see in headlines, effective is what you actually feel in your wallet (Investopedia explainer).

Tax credits vs. tax deductions, which is better?

Easy: credits are king 👑. A credit reduces your tax bill dollar-for-dollar. Deductions just reduce taxable income, which saves you less in the end. So, if you ever get the choice, credits win.

Can I deduct medical expenses?

Yes, but only if your unreimbursed medical expenses are more than 7.5% of your Adjusted Gross Income (AGI). And you’ll have to itemize. So if you had a tough medical year, it might pay off.

Should I itemize or just take the standard deduction?

Compare the two and see which gives you more. For 2025, the standard deduction is $14,600 (single) or $29,200 (married filing jointly). If your itemized deductions add up to more than that, go itemized. Otherwise, standard keeps things simple.

How do I stay updated on new tax laws?

Follow the IRS Newsroom, reliable tax blogs, or check in with a CPA. As Benjamin Franklin once said, “In this world nothing can be said to be certain, except death and taxes.” At least with updates, you’ll be ready for the second one!

How do I get my W-2 or a tax transcript?

Head to the IRS website and use their Get Transcript tool, or file Form 4506-T. Your employer can also give you your W-2 directly.

What if I get an incorrect W-2?

Start by reaching out to your employer. If that doesn’t work, call the IRS (800-829-1040) or file Form 4852 as a backup.

My refund check got lost, what now?

Don’t panic. Use the “Where’s My Refund?” tool or call 800-829-1954. If you filed jointly, you might need to send in Form 3911 to track it down.

What are the rules for claiming a child as a dependent?

Basically, the child has to be under 19 (or under 24 if a student), live with you most of the year, not file a joint return, and pass the citizenship/residency tests.

How is inherited property taxed when I sell it?

You inherit it at the fair market value (FMV) on the date of death. If you sell it for more than that, the gain is taxable and gets reported on Schedule D and Form 8949. If you sell for less, you might even have a loss.

Is a minister’s housing allowance taxable?

For income tax? Nope, it’s excluded. But for self-employment tax, yes, it’s included. The details are in IRS Publication 517.