You’ve probably heard this saying many times: “Invest while you’re young.” Usually it means stocks or sometimes real estate. But I’ve also seen people who are quietly investing money in bonds in their 20s and 30s. And it’s not because they’re bored.

Bonds have a bit of a strange image. People think these were only meant for parents or grandparents’ time, not for young people. But the real thing is something else. When inflation went up in 2022-23, the stock market became a roller coaster, then many young investors asked, “Are bonds safe? Should I buy them?”

I have a friend, 28 years old, who works in tech. She shifted some part of her savings to U.S. Treasury bonds. She said, “I feel like I’m parking my money in a safe lane,” and I think she was right.

In this guide I will tell you how bonds actually work, why bonds suddenly became everyone’s favorite safe haven, and when they can be best for you (and when they should be ignored). So let’s get started.

What Are Bonds and How Do They Work

Bonds are not magic. You lend your money to the government or company, which promises to return it with interest.

Suppose someone borrowed $100 from you for a year and promised to give you $5 extra. The only difference is that in stocks you buy a share in the company, with bonds you receive fixed interest and your principal back at maturity.

But remember that bonds are also not risk-free. If interest rates increase, the value of old bonds can fall. In 2023, one-year bonds of U.S. Treasury were giving more than 5% interest, a rate which people have not seen in years. That is why young investors are also taking interest in bonds now

Why Americans Are Buying More I Bonds in Recent Years

I still remember when I first heard about I Bonds in 2022. Inflation was at its peak, and everything was getting expensive.

And during those days, I got a call from a friend and he said, “Hey, have you checked the new rates of I Bonds?” And that is where my acquaintance with bonds began.

In fact: An I Bond is a U.S. government savings bond that gives you interest in two parts,

- Fixed rate (which remains the same throughout the duration of the bond).

- Inflation rate (which changes every 6 months according to the Consumer Price Index).

That’s why in October, 2022, Americans bought I Bonds worth $6.8 billion, mostly by teachers, engineers, and new parents rather than the wealthy.

But remember that, the rate of I Bonds is not always this high. By 2025 it is at 3.98%, which is still quite good, but not a peak like 2022. Personally, I consider I Bonds like a fire extinguisher: when inflation flares up, they help.

Bonds vs Stocks Which One Fits Your Goals?

The comparison of bonds vs stocks is something like that of coffee and green tea. Both give caffeine, but the effect is different, so you have to think what you want.

Stocks are like double espresso, give a powerful boost, but sometimes increase stress too. You buy a share of the company, if the company grows you benefit, if it falls you suffer loss.

Bonds are like green tea, calm and steady. You lend money, get interest, and on maturity you get the real money back. Are stocks safer? Often, yes, but not completely risk-free.

Example: If you invest $10,000 in S&P 500 in January 2022, it would be down 20% by October. If that money was in one-year U.S. Treasury bonds, you could have earned more than 4% comfortably, without stress.

I am not saying sell all stocks and buy bonds. Some people in their 20s keep 90% stocks and 10% bonds for safety. Some do a 60/40 split because it helps them sleep well through the market’s ups and downs.

For me the real question is not which investment is better, but which one keeps you confident about your plan without worrying. Because the best portfolio is the one that you can hold even in difficult times.

Pros and Cons of Investing into Bonds

Let’s get straight to the point: no investment is a free lunch. Bonds have their own advantages and disadvantages that I believe everyone needs to understand.

PROS:

- Predictable income: Bonds give you fixed interest (like a coupon) on time, similar to getting a salary, but from the government or a company.

- Low volatility: Stocks behave like a roller coaster, but bonds are like a Ferris wheel; the movement is slow and smooth.

- Safety factor: From what I understand, it’s hard to lose money in U.S. Treasuries, which is why they are considered safe.

- Diversification: Adding bonds to a portfolio reduces overall risk. When stocks fall, bonds tend to remain stable or go up.

CONS:

- Lower returns: In the long run, stocks generally earn more. Bonds are for stability, not for thrill.

- Interest rate risk: If you buy a bond at 4% and rates rise to 6%, the value of your bond falls.

- Inflation risk: If inflation is higher than the bond’s interest rate, your “safe” return actually becomes weaker.

How to Buy Bonds in the U.S.

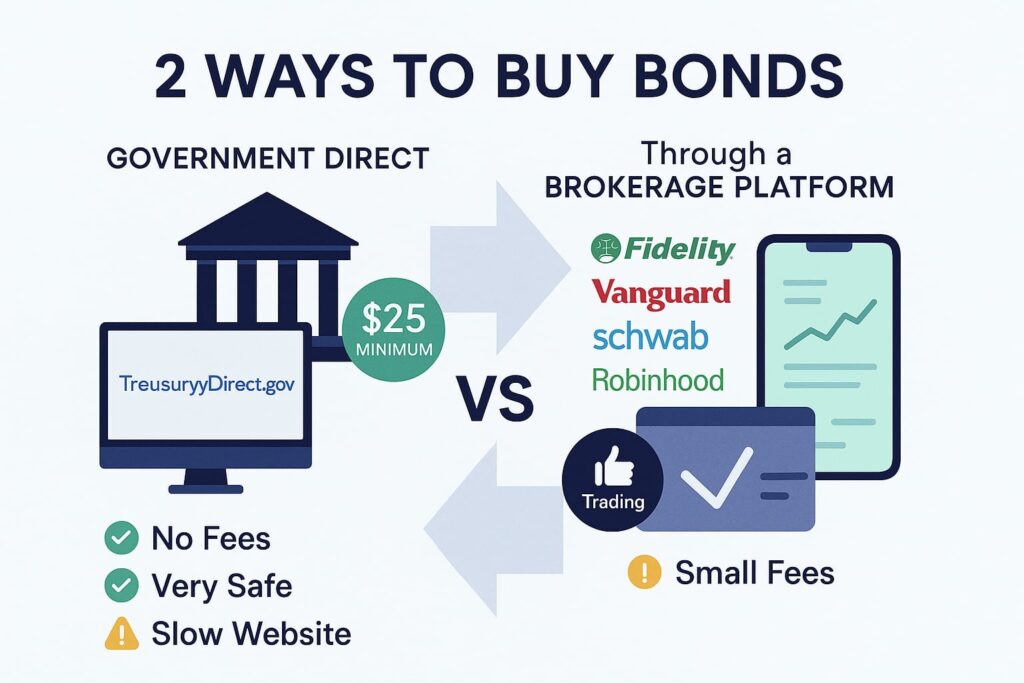

1. Directly from the U.S. Government2:

- Website: TreasuryDirect.gov

- Buy: Treasury bills, notes, bonds, I Bonds

- Min. purchase: $25 (I Bonds), $100 (others)

- Pro: No fees, very safe

- Con: The website can feel old and slow.

2. Through a Brokerage Account

- Platforms: Fidelity, Vanguard, Schwab, Robinhood

- Buy: Government, corporate, municipal bonds, bond ETFs

- Pro: Easy if you already buy stocks

- Con: Sometimes involves small fees / slightly lower rates.

When Bonds Make the Most Sense

The truth is, my friend, there’s no perfect time to buy bonds, but they are useful in certain situations. Think of them like a winter jacket; you can wear it in the summer, but the real benefit is in the cold.

So, when should you buy bonds?

- Short-term goals: They protect plans for 1–5 years (like a down payment on a house, a wedding, or grad school) from a market crash.

- Low risk or nearing retirement: They protect wealth, even for young, risk-averse people.

- High interest rates: When rates are high, you can lock in a good yield, and if rates fall later, the bond’s value can increase.

- Market crashes: When stocks are falling, bonds stay stable or go up, which gives you an opportunity to buy cheap stocks.

Note: Don’t buy bonds just because they “feel safe.” If inflation is higher than the yield, you can lose purchasing power. (So yes, timing and context matter.)

As Morgan Housel writes in The Psychology of Money:

“Risk is what’s left over when you think you’ve thought of everything.”

Key Takeaways Before You Invest

My personal tip:

I keep at least 10–20% of my portfolio in bonds. When the market crashes, I have the option to rebalance, and this saves me from panic-selling.

Always remember one thing: “The best investment strategy is the one that lets you sleep at night.” Unknown, but probably someone who lived through 2008.

Conclusion

The purpose of bonds isn’t thrill; it’s balance. When the market is stormy, they keep your portfolio stable. For me, they’re like that friend who always shows up on time, doesn’t make a fuss, but always gets the job done.

Safe? Often, but not perfect. They don’t protect against inflation and some other risks, but they provide a strong, predictable place for your money.

Don’t think of bonds as “old people investments.” They are a tool in the toolbox. Sometimes you need stocks, sometimes cash, and sometimes stability. Look at your goals, timeline, and risk tolerance, then decide whether bonds deserve a place in your portfolio.

If you are also interested in knowing about the stock market then click here.